Claim For Exemption Form

Download a blank fillable Claim For Exemption Form in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Claim For Exemption Form with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

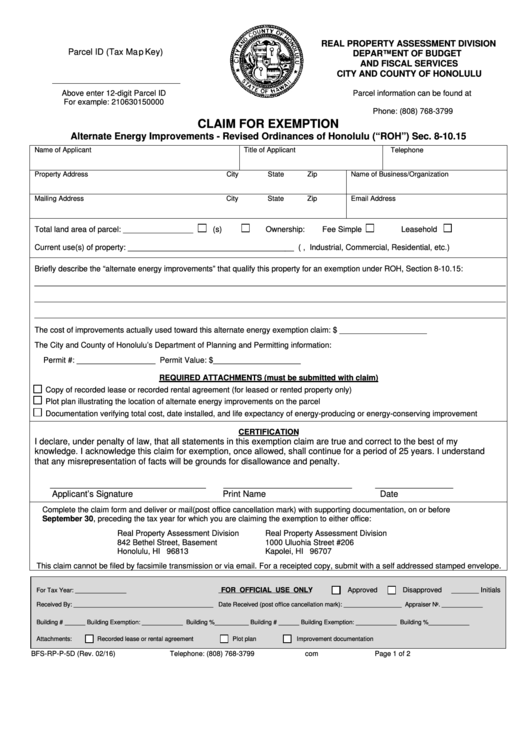

REAL PROPERTY ASSESSMENT DIVISION

Parcel ID (Tax Map Key)

DEPARTMENT OF BUDGET

AND FISCAL SERVICES

CITY AND COUNTY OF HONOLULU

Above enter 12-digit Parcel ID

Parcel information can be found at

For example: 210630150000

Phone: (808) 768-3799

CLAIM FOR EXEMPTION

Alternate Energy Improvements - Revised Ordinances of Honolulu (“ROH”) Sec. 8-10.15

Name of Applicant

Title of Applicant

Telephone

Property Address

City

State

Zip

Name of Business/Organization

Mailing Address

City

State

Zip

Email Address

Total land area of parcel: ________________

Sq.Ft.

Acre(s)

Ownership:

Fee Simple

Leasehold

Current use(s) of property: ______________________________________ (i.e., Industrial, Commercial, Residential, etc.)

Briefly describe the “alternate energy improvements” that qualify this property for an exemption under ROH, Section 8-10.15:

_________________________________________________________________________________________________________________________

_________________________________________________________________________________________________________________________

_________________________________________________________________________________________________________________________

The cost of improvements actually used toward this alternate energy exemption claim: $ ____________________

The City and County of Honolulu’s Department of Planning and Permitting information:

Permit #: __________________ Permit Value: $____________________

REQUIRED ATTACHMENTS (must be submitted with claim)

Copy of recorded lease or recorded rental agreement (for leased or rented property only)

Plot plan illustrating the location of alternate energy improvements on the parcel

Documentation verifying total cost, date installed, and life expectancy of energy-producing or energy-conserving improvement

CERTIFICATION

I declare, under penalty of law, that all statements in this exemption claim are true and correct to the best of my

knowledge. I acknowledge this claim for exemption, once allowed, shall continue for a period of 25 years. I understand

that any misrepresentation of facts will be grounds for disallowance and penalty.

________________________________________

_________________________________

____________________

Applicant’s Signature

Print Name

Date

Complete the claim form and deliver or mail (post office cancellation mark) with supporting documentation, on or before

September 30, preceding the tax year for which you are claiming the exemption to either office:

Real Property Assessment Division

Real Property Assessment Division

842 Bethel Street, Basement

1000 Uluohia Street #206

Honolulu, HI 96813

Kapolei, HI 96707

This claim cannot be filed by facsimile transmission or via email. For a receipted copy, submit with a self addressed stamped envelope.

FOR OFFICIAL USE ONLY

Approved

Disapproved

_______ Initials

For Tax Year: _______________

Received By: _________________________________________ Date Received (post office cancellation mark): _________________ Appraiser No. ____________

Building # ______ Building Exemption: ____________ Building %__________ Building # ______ Building Exemption: ____________ Building %____________

Attachments:

Recorded lease or rental agreement

Plot plan

Improvement documentation

BFS-RP-P-5D (Rev. 02/16)

Telephone: (808) 768-3799

Page 1 of 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2