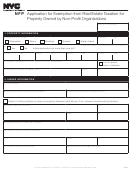

Application For Exemption From Real Estate Taxation For Property Owned By Nonprofit Organizations - 2013 Page 3

ADVERTISEMENT

Real Estate Tax Exemption Application for Nonprofit Organizations

Page 3

S E C T I O N 4 - P R O P E R T Y U S E - C o n t i n u e d

I I

I I

8.

Is the property or any portion thereof occasionally used by persons or organizations other than the applicant? .......................................................

YES

NO

9.

If "yes," state use and indicate specific portion of the property used, frequency of use, and fee charged or contributions received for use: ______________________

___________________________________________________________________________________________________________________________________

___________________________________________________________________________________________________________________________________

10. If there are no buildings or other improvements, describe the use of this lot: _______________________________________________________________________

I I

I I

11. If there are no buildings or improvements, are such contemplated?...........................................................................................................................

YES

NO

12. If "yes," indicate anticipated date of construction start: _________ / _________ / _________

13. If buildings or other improvements are contemplated, give full details of proposed use(s): _____________________________________________________________

____________________________________________________________________________________________________________________________________

I I

I I

14. Do the minutes of the organization contain a resolution(s) authorizing the contemplated building or other improvement?........................................

YES

NO

IF "YES," ATTACH A COPY OF RESOLUTION(S).

15. State detailed financial resources for contemplated buildings or other improvements: ________________________________________________________________

___________________________________________________________________________________________________________________________________

S E C T I O N 5 - O R G A N I Z A T I O N S T A T E M E N T O F R E C E I P T S A N D E X P E N D I T U R E S

COMPLETE ONLY IF SECTION 3, QUESTIONS 1 OR 5 WERE ANSWERED "NO."

STATEMENT OF RECEIPTS AND EXPENDITURES FOR THE LAST FISCAL YEAR ENDING ______ / ______ / ______

RECEIPTS

1. Gross dues and assessments of members ..................................................................................................................

1.

2. Gross contributions, gifts, etc. ......................................................................................................................................

2.

3. Gross amount derived from activities related to organizations exempt

purpose(s)

.............................................................................................

(attach schedule)

3.

Less: Cost of sales

(attach schedule) .........................................................................................

4. Gross amounts from unrelated business activities

................................

(attach schedule)

Less: Cost of sales..........................................................................................................

4.

5. Gross amount received from sales of assets, excluding inventory items

(attach schedule)

Less: Cost or other basis and sales expense of assets sold

5.

(attach schedule) ...................

6. Interest, dividends, rents and royalties.........................................................................................................................

6.

7. Other receipts

.....................................................................................................................................

7.

(attach schedule)

8. TOTAL RECEIPTS (add lines 1 through 7) .................................................................................................................

8.

EXPENDITURES

9. Fund raising expenses .................................................................................................................................................

9.

10. Contributions, gifts, grants and similar amounts paid

.........................................................................

(attach schedule)

10.

11. Disbursements to or for the benefit of members

................................................................................

(attach schedule)

11.

12. Compensation of officers, directors and trustees.........................................................................................................

12.

13. Other salaries and wages ............................................................................................................................................

13.

14. Interest .........................................................................................................................................................................

14.

15. Rent..............................................................................................................................................................................

15.

16. Depreciation and depletion ..........................................................................................................................................

16.

17. Other expenditures

.............................................................................................................................

(attach schedule)

17.

18. TOTAL EXPENDITURES (add lines 9 through 17)......................................................................................................

18.

19. EXCESS OF RECEIPTS OVER EXPENDITURES (line 8 less line 18) ......................................................................

19.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4