Form Cd-0363-0605 Employers' Certification: Death Claim

ADVERTISEMENT

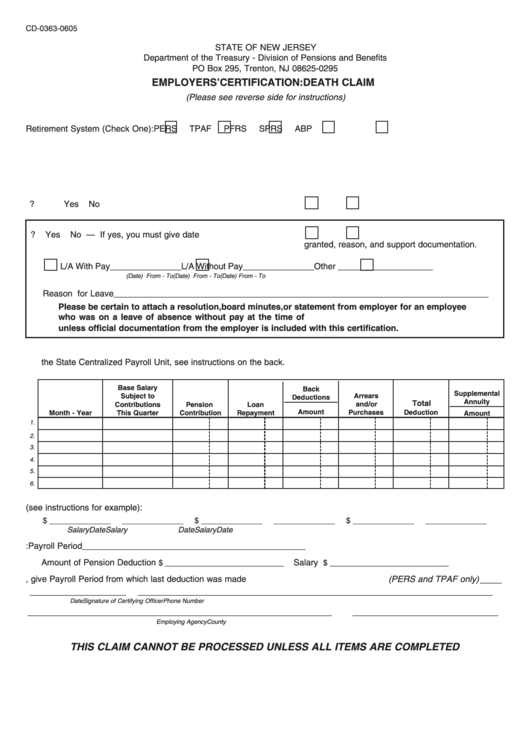

CD-0363-0605

STATE OF NEW JERSEY

Department of the Treasury - Division of Pensions and Benefits

PO Box 295, Trenton, NJ 08625-0295

EMPLOYERS’ CERTIFICATION: DEATH CLAIM

(Please see reverse side for instructions)

Retirement System (Check One):

PERS

TPAF

PFRS

SPRS

ABP

1. Name of Deceased ____________________________

2. Membership No. ______________________________

3. Date Employed _______________________________

4. Social Security Number _________________________

5. Last Day of Active Service ______________________

6. Date of Death ________________________________

7. Was death due to an accident in the course of employment?

Yes

No

8. Was member on an official leave of absence with or without pay?

Yes

No — If yes, you must give date

granted, reason, and support documentation.

L/A With Pay _______________

L/A Without Pay _______________

Other ____________________

(Date) From - To

(Date) From - To

(Date) From - To

Reason for Leave _______________________________________________________________________________

Please be certain to attach a resolution, board minutes, or statement from employer for an employee

who was on a leave of absence without pay at the time of death. This claim cannot be processed

unless official documentation from the employer is included with this certification.

9. Base salaries during the last 6 months of creditable service prior to date of death. For those employees paid through

the State Centralized Payroll Unit, see instructions on the back.

Base Salary

Back

Supplemental

Arrears

Subject to

Deductions

Annuity

Total

and/or

Contributions

Pension

Loan

Amount

Purchases

Deduction

Month - Year

This Quarter

Contribution

Repayment

Amount

1.

2.

3.

4.

5.

6.

10. Annual salaries and effective dates of wages in last year of service (see instructions for example):

$ ______________

______________

$ ______________

______________

$ ______________

______________

Salary

Date

Salary

Date

Salary

Date

11. Last Deduction Made for Retirement System: Payroll Period

___________________________________________________

Amount of Pension Deduction

_________________________

Salary

_________________________

$

$

12. If Contributory Insurance in force, give Payroll Period from which last deduction was made (PERS and TPAF only)

_____

______________________

_______________________________________________________

__________________________

Date

Signature of Certifying Officer

Phone Number

_______________________________________________________________________

__________________________________

Employing Agency

County

THIS CLAIM CANNOT BE PROCESSED UNLESS ALL ITEMS ARE COMPLETED

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2