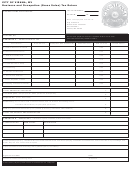

Aurora Occupational Privilege Tax Return Form - City Of Aurora Page 2

ADVERTISEMENT

INSTRUCTIONS FOR COMPLETING FRONT OF FORM

LINE A

This line should include all employees that receive gross compensation of $250 or

more in a month and work all or part of their time within Aurora. (Employees that

have furnished form WC/AOPT verifying another employer is withholding would be

excluded from this total.

LINE B

This line should include all employees that receive gross compensation of $250 or

more in a month and work all or part of their time within Aurora. This figure should

include all employees even though the employee may have another employer that is

withholding.

LINE C

This line is a total of the employees on line A and line B multiplied by the tax rate of

$2.00 per month.

LINE D

Include Penalty of 10% if return is not filed by due date indicated on front of form.

LINE E

Include interest of 1% for each month the return is filed after the due date.

LINE F

Credits: Include a full explanation of reason for the credit claimed. Attach

appropriate documentation with all details.

LINE G

This line is a total of lines C plus D plus E minus F. If you file a tax return showing

“NO TAX LIABILITY”, please include a full explanation.

WHO ARE EMPLOYEES?

An “Employee” means any person who is subject to income tax withholding pursuant to the

provisions of the Federal Internal Revenue Code of 1986, and the regulations promulgated

thereunder.

For further help in determining who is an employee for the purposes of OPT withholding and

payment please contact the Tax & Licensing Division at (303) 739-7800. You may review

information on City Taxes on the Finance Department Web page at [ ].

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2