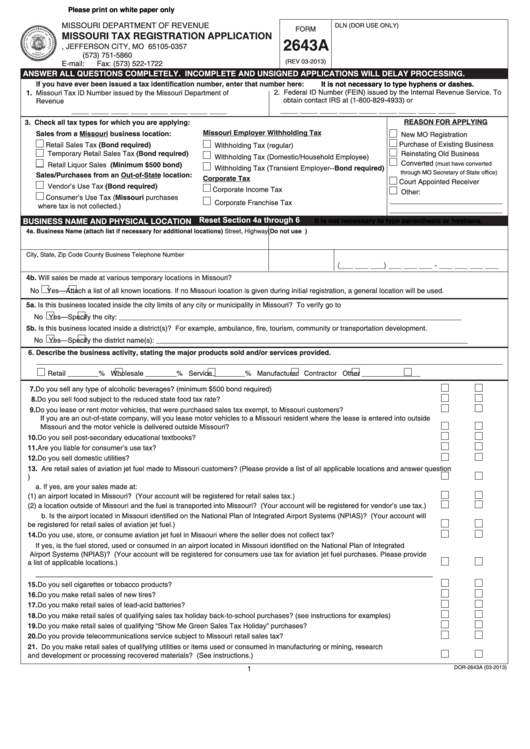

Please print on white paper only

MISSOURI DEPARTMENT OF REVENUE

DLN (DOR USE ONLY)

FORM

MISSOURI TAX REGISTRATION APPLICATION

Reset ALL PAGES of Form

2643A

P.O. BOX 357, JEFFERSON CITY, MO 65105-0357

Print ALL PAGES of Form

(573) 751-5860

(REV 03-2013)

E-mail: businesstaxregister@dor.mo.gov

Fax: (573) 522-1722

ANSWER ALL QUESTIONS COMPLETELY. INCOMPLETE AND UNSIGNED APPLICATIONS WILL DELAY PROCESSING.

If you have ever been issued a tax identification number, enter that number here:

It is not necessary to type hyphens or dashes.

1. Missouri Tax ID Number issued by the Missouri Department of

2. Federal ID Number (FEIN) issued by the Internal Revenue Service. To

obtain contact IRS at (1-800-829-4933) or

Revenue

____ ____ ____ ____ ____ ____ ____ ____ ____

____ ____ ____ ____ ____ ____ ____ ____

Reset Section 1 through 3

REASON FOR APPLYING

3. Check all tax types for which you are applying:

Missouri Employer Withholding Tax

Sales from a Missouri business location:

New MO Registration

Retail Sales Tax (Bond required)

Purchase of Existing Business

Withholding Tax (regular)

Temporary Retail Sales Tax (Bond required)

Reinstating Old Business

Withholding Tax (Domestic/Household Employee)

Converted

Retail Liquor Sales (Minimum $500 bond)

(must have converted

Withholding Tax (Transient Employer--Bond required)

through MO Secretary of State office)

Sales/Purchases from an Out-of-State location:

Corporate Tax

Court Appointed Receiver

Vendor’s Use Tax (Bond required)

Corporate Income Tax

Other:

Consumer’s Use Tax (Missouri purchases

_____________________________

Corporate Franchise Tax

where tax is not collected.)

_____________________________

Reset Section 4a through 6

BUSINESS NAME AND PHYSICAL LOCATION

It is not necessary to type parenthesis or hyphens.

4a. Business Name (attach list if necessary for additional locations)

Street, Highway (Do not use P.O. Box Number or Rural Route Number)

City, State, Zip Code

County

Business Telephone Number

(___ ___ ___) ___ ___ ___ - ___ ___ ___ ___

4b. Will sales be made at various temporary locations in Missouri?

No

Yes—Attach a list of all known locations. If no Missouri location is given during initial registration, a general location will be used.

5a.

Is this business located inside the city limits of any city or municipality in Missouri? To verify go to https://dors.mo.gov/tax/strgis/index.jsp

No

Yes—Specify the city: ________________________________________________________________________________________

5b. Is this business located inside a district(s)? For example, ambulance, fire, tourism, community or transportation development.

No

Yes—Specify the district name(s): ________________________________________________________________________________

6. Describe the business activity, stating the major products sold and/or services provided.

Retail ________%

Wholesale ________%

Service ________%

Manufacturer

Contractor

Other _______________

Reset Section 7 through 21

7. Do you sell any type of alcoholic beverages? (minimum $500 bond required) .................................................................................

Yes

No

8. Do you sell food subject to the reduced state food tax rate? .............................................................................................................

Yes

No

9. Do you lease or rent motor vehicles, that were purchased sales tax exempt, to Missouri customers? ............................................

Yes

No

If you are an out-of-state company, will you lease motor vehicles to a Missouri resident where the lease is entered into outside

Missouri and the motor vehicle is delivered outside Missouri? ........................................................................................................

Yes

No

10. Do you sell post-secondary educational textbooks? ..........................................................................................................................

Yes

No

11. Are you liable for consumer’s use tax? ..............................................................................................................................................

Yes

No

12. Do you sell domestic utilities? ............................................................................................................................................................

Yes

No

13. Are retail sales of aviation jet fuel made to Missouri customers? (Please provide a list of all applicable locations and answer question

13.b. for each location) .........................................................................................................................................................................

Yes

No

a. If yes, are your sales made at:

(1) an airport located in Missouri? (Your account will be registered for retail sales tax.) .............................................................

Yes

No

(2) a location outside of Missouri and the fuel is transported into Missouri? (Your account will be registered for vendor’s use tax.) .....

Yes

No

b. Is the airport located in Missouri identified on the National Plan of Integrated Airport Systems (NPIAS)? (Your account will

be registered for retail sales of aviation jet fuel.) ..........................................................................................................................

Yes

No

14. Do you use, store, or consume aviation jet fuel in Missouri where the seller does not collect tax? ..................................................

Yes

No

If yes, is the fuel stored, used or consumed in an airport located in Missouri identified on the National Plan of Integrated

Airport Systems (NPIAS)? (Your account will be registered for consumers use tax for aviation jet fuel purchases. Please provide

a list of applicable locations.) .............................................................................................................................................................

Yes

No

______________________________________________________________________________________________________

15. Do you sell cigarettes or tobacco products? ......................................................................................................................................

Yes

No

16. Do you make retail sales of new tires? ..............................................................................................................................................

Yes

No

17. Do you make retail sales of lead-acid batteries? ...............................................................................................................................

Yes

No

18. Do you make retail sales of qualifying sales tax holiday back-to-school purchases? (see instructions for examples) .....................

Yes

No

19. Do you make retail sales of qualifying “Show Me Green Sales Tax Holiday” purchases? ................................................................

Yes

No

20. Do you provide telecommunications service subject to Missouri retail sales tax?.............................................................................

Yes

No

21. Do you make retail sales of qualifying utilities or items used or consumed in manufacturing or mining, research

and development or processing recovered materials? (See instructions.) .......................................................................................

Yes

No

DOR-2643A (03-2013)

1

1

1 2

2 3

3 4

4