Reset Section 30

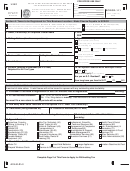

BUSINESS MAILING ADDRESS (Reporting Forms and Notices are mailed to this address.)

30. Street, Route or PO Box Number

City

State

Zip Code

___ ___ ___ ___ ___

Which forms do you want mailed to this address?

All Tax Types

Sales/Use Tax

Corporate Income Tax

Employer Withholding Tax

RECORD STORAGE ADDRESS (Provide the address where your tax records are kept. Do not use PO Box Numbers.)

31. Street, Highway

City

State

Zip Code

___ ___ ___ ___ ___

MEMBERS (IF AN LLC), OFFICERS, OR PARTNERS. LISTING INDIVIDUALS OR ENTITIES HERE INDICATES THEY HAVE DIRECT

SUPERVISION OR CONTROL OVER TAX MATTERS. Attach list if needed.

Reset Section 32 through 34

It is not necessary to type hyphens or dashes.

32. Name (Last, First, Middle Initial)

Title

FEIN

Social Security No.

Birthdate(MM/DD/YYYY)

__ __ __ __ __ __ __ __ __

__ __ /__ __ /__ __ __ __

__ __ __ __ __ __ __ __ __

Home Address

City

State

Zip Code

County

Effective Date of Title

__ __ /__ __ /__ __ __ __

__ __ __ __ __

It is not necessary to type hyphens or dashes.

33. Name (Last, First, Middle Initial)

Title

FEIN

Social Security No.

Birthdate(MM/DD/YYYY)

__ __ __ __ __ __ __ __ __

__ __ /__ __ /__ __ __ __

__ __ __ __ __ __ __ __ __

Home Address

City

State

Zip Code

County

Effective Date of Title

__ __ __ __ __

__ __ /__ __ /__ __ __ __

It is not necessary to type hyphens or dashes.

34. Name (Last, First, Middle Initial)

Title

FEIN

Social Security No.

Birthdate(MM/DD/YYYY)

__ __ __ __ __ __ __ __ __

__ __ /__ __ /__ __ __ __

__ __ __ __ __ __ __ __ __

Home Address

City

State

Zip Code

County

Effective Date of Title

__ __ __ __ __

__ __ /__ __ /__ __ __ __

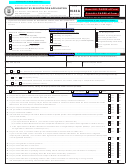

SALES OR USE TAX

Reset Section 35 through 39

35. Taxable Sales or Taxable Purchases Begin Date:

M

M

D

D

Y

Y

Temporary License

FROM:

M

M

D

D

Y

Y

TO

M

M

D

D

Y

Y

(Example: fireworks, temporary event, etc.)

36. Seasonal Business: If you do not make taxable sales year round, please check the months that you do:

January

February

March

April

May

June

July

August

September

October

November

December

37. Estimated state sales/use tax liability (check one)

1. Monthly (Over $500 a month)

2. Quarterly ($500 or less a month)

3. Annually (less than $100 a quarter)

38. COMPUTE AMOUNT OF BOND

*

Estimated Monthly Taxable Sales

Average Tax Rate

Monthly Tax

Amount of Bond

6.991%

X

=

X 3 =

_______________________________

____________________

_______________________

________________________________

(Round to nearest $10)

If you will be using your actual tax rate instead of the Missouri average rate, visit

to obtain sales tax rate information.

*If you calculate the amount of bond to be less than $500, you are only required to submit a $25 bond ($500 minimum bond for liquor sales). If you

calculate your bond to be $500 or greater, you should submit the amount of bond figured. If the Department determines the bond is insufficient to cover

your tax liability, the Director of Revenue may require you to adjust the bond amount to a level satisfactory to cover your tax liabilities or if returns are not

filed timely and the taxes fully paid. See

CSR

10-104.020.

Attach the appropriate bond form to your registration based on the type of bond checked.

Access FAQ’s at

Access bond forms at

39. Type of Bond (No personal or company checks)

1. Surety Bond

2. Cash Bond

3. Irrevocable Letter of Credit

4. None Required

5. Certificate of Deposit

CORPORATE INCOME OR FRANCHISE TAX

Reset Section 40 through 42

40. Is this corporation registered with the Internal Revenue Service as a:

Regular or Close Corporation

Sub Chapter S Corporation

41. Corporate Tax Begin Date in Missouri:

M

M

D

D

Y

Y

Corporate Taxable Year End: M

M

D

D

42. Will the corporation be required to make quarterly estimated Missouri income tax payments? If the Missouri Estimated Tax is expected to be at least

$250, or 6.25% of the Missouri taxable income, check the “yes” box.

Yes

No

See instructions for Privacy Notice.

DOR-2643A (03-2013)

3

Go to previous page

Go to next page

1

1 2

2 3

3 4

4