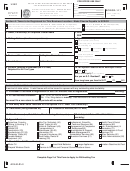

Reset Section 43 through 47

EMPLOYER WITHHOLDING TAX

43. Missouri Withholding Begin Date:

M

M

D

D

Y

Y

How many of your employees will work in Missouri?

44. Calculate estimated withholding tax:

Estimated monthly gross wages ________________________ x 6% = ____________________________

A. Annually, less than $20 withholding

M. Monthly, $500 to $9,000 withholding tax per month

tax per quarter

Q. Quarterly, $20 withholding tax per quarter

W. Quarter/Monthly (weekly), over $9,000 withholding tax per month

(required to pay tax electronically)

to $500 per month

45. Does a parent company file withholding tax reports and receive full compensation for timely filed returns?

Yes

No

46. If you do not pay wages year round, please check the months that you do pay wages.

January

February

March

April

May

June

July

August

September

October

November

December

47. Withholding Tax Courtesy Mailing Address (a copy of all withholding tax delinquent notices will be mailed to this address)

Business Name (DBA Name)

Street, Route or PO Box

City

State

Zip Code

County

___ ___ ___ ___ ___

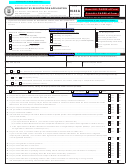

48. Are you a Transient Employer?

No

Yes (If yes, must complete the “Employer Withholding Tax” section above)

If you are an employer not domiciled in Missouri and are temporarily transacting business in Missouri for less than 24 consecutive months, you will be

defined as a Transient Employer. (Example: contractor, temporary staffing agency, etc.) For additional information you may contact us at

businesstaxregister@dor.mo.gov or call (573) 751-0459.

Reset Section 48

A Transient Employer must submit with this application:

• A completed insurance certification slip indicating Missouri as a covered state for Workers’ Compensation

• Your Missouri employment security account number issued by the Division of Employment Security

• Your Missouri Certificate of Authority Number issued by the corporate division of the Missouri Secretary of State’s Office

• A Transient Employer Bond not less than $5,000, not more than $25,000.

CALCULATE TRANSIENT EMPLOYER BOND

A. Missouri Withholding Tax

Monthly Gross Wages

__________________ x 6% = ________________ x 3 = _________________(a)

B. Missouri Unemployment Tax

Average # of Workers

__________________ x $7,000 = _______________ x 3.38% = _______________ / 4 = _________________ (b)

(a) ____________________ + (b) ____________________ = _________________________ (Amount of bond—minimum $5,000)

Access bond forms at

TYPE OF BOND

Surety Bond

Cash Bond

Irrevocable Letter of Credit

Certificate of Deposit

Comments:

SIGNATURE (MUST BE LISTED IN THE “OWNERSHIP TYPE” SECTION WHICH ALSO INDICATES THEY HAVE DIRECT

SUPERVISION OR CONTROL OVER TAX MATTERS.)

No digital signatures allowed

49.

Under penalties of perjury, I declare that the above information and any attached supplements is true, complete, and correct. The application

must be signed by the owner, if the business is a sole ownership; partner, if the business is a partnership; reported officer, if the business is a

corporation or by a member, if the business is a L.L.C. as listed on this application.

SIGNATURE (For acceptable signature, see above)

TITLE

DATE(MM/DD/YYYY)

__ __ / __ __ / __ __ __ __

PRINT NAME

E-MAIL ADDRESS

CONFIDENTIALITY OF TAX RECORDS

Missouri Statute 32.057, RSMo, states that all tax records and information maintained by the Missouri Department of Revenue are confidential. The tax information can only

be given to the owner, partner, member, or officer who is listed with us as such. If you wish to give an employee, attorney, or accountant access to your tax information,

you must supply us with a power of attorney giving us the authority to release confidential information to them. (Visit our web site at to obtain

.

DOR-2827, Power of Attorney Form)

TDD (800) 735-2966

DOR-2643A (03-2013)

4

1

1 2

2 3

3 4

4