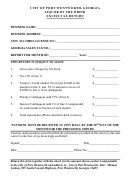

SUPPLIER LIQUOR EXCISE TAX RETURN

INSTRUCTIONS

th

Tax is due and payable on or before the 20

of the month following activity per NRS 369.370. Late filing

will result in a penalty (up to 10%) and interest of 1% per month until the date of payment per NRS

360.417. The return must be filed whether or not there is activity.

1.– 4. On the appropriate Liquor Type/alcohol percent line, enter the total Wine Gallons shipped to

Nevada residents, totaled from all invoices for the month. Multiply the gallons by the Tax Rate and enter

on the Tax Amount Due line.

5. Total the Wine Gallons and Tax Amount Due columns and enter on the Totals line.

th

6. If postmarked on or before the 15

of the month following activity, enter the 0.25% Discount and

subtract from the Total.

7. Adjusted Tax total less the discount.

8. Subtract credits that have been approved by the Department.

9. If this return will not be submitted/postmarked and the taxes paid on or before the due date

as shown on the face of this return, the amount of penalty due is based on the number of days late the

payment is made per NAC 360.395. The maximum penalty amount is 10%.

Number of days

Penalty

late

Percentage

Multiply by:

1 - 10

2%

0.02

11 - 15

4%

0.04

16 - 20

6%

0.06

21- 30

8%

0.08

31 +

10%

0.10

Determine the number of days late the payment is, and multiply the net tax owed by the appropriate rate

based on the table above. The result is the amount of penalty that should be entered. For example, the

taxes were due January 31, but not paid until February 15. The number of days late is 15 so the penalty

is 4%.

10. Effective 07/01/2011 interest rate change: To calculate interest for each month late after 07/01/2011,

th

of the month following activity. To

multiply Line 7 x 0.76% (or .0075), if postmarked after the 20

calculate interest for each month late from 07/01/1999 through 06/30/2011 multiply Line 7 x .01% (or .01)

th

if postmarked after the 20

of the following month.

11. Include liabilities that have been established by the Department.

12. Total Amount Due and payable to the Department of Taxation.

Attach legible copies of all invoices to the return. Invoices must include date; name and address of

Nevada resident; and type, percentage of alcohol; and quantity of alcoholic beverages shipped.

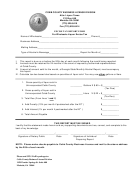

CONVERSION TO GALLONS

Per NAC 369.020

Reports of licensees must be in wine gallons.

For Wine, the quantity in liters must be multiplied by 0.26417 to determine the equivalent quantity in wine

gallons. The resulting figures must be rounded to the nearest one-hundredth of a gallon.

For Distilled Spirits, to convert liters to wine gallons, the quantity in liters must be multiplied by 0.264172

to determine the equivalent quantity in wine gallons. The resulting figure must be rounded to the nearest

one-hundredth of a gallon.

Example: Bottles times milliliters = total milliliters

Divide total milliliters by 1000 = total liters

Multiply total liters by .26417 for wine or .264172 for spirits = total wine gallons

LIQ-STC (05/15)

1

1 2

2