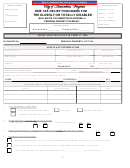

Application For Real Estate Tax Exemption For Elderly Or Permanently/totally Disabled Homeowners Form Page 3

ADVERTISEMENT

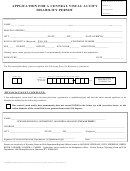

City of Winchester, Tax Relief Application: _________________________________________________________________

Gross Income for the Past Calendar Year:

Enter the gross income before deduction from all sources, for calendar year 2015, of the applicant, spouse,

and all other relatives/ contributing members living in the dwelling. (Other than necessary caretaker or bona fide

tenant) List each person’s income separately. Use additional sheets if necessary. You must attach supporting

documentation for each amount listed.

Yearly Gross Income

Applicant

Spouse

Other

Salaries, Wages, etc.

Social Security

Pensions

Rental Income

Interest and Dividends

Social Services (Welfare)

Capital Gains

Alimony and Child Support

Other Income

Total Yearly Gross Income:

Total Combined Gross Income of Applicant, Spouse and Other Contributing Members: $ _________________

IF THE ABOVE TOTAL EXCEEDS $40,000 YOU DO NOT QUALIFY THIS YEAR. Please return this form or

notify the Commissioner of the Revenue office if you wish to receive an application next year.

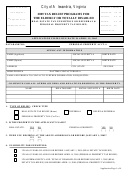

Net Financial Worth at End of Past Calendar Year:

Applicant’s Value

Spouse’s Value

Assets

Cash – on hand and in banks

(Checking and Savings)

Stocks, bonds, IRAs, CDs, Trusts

(Attach listing)

Real estate other than primary dwelling

(Attach listing)

Other personal property

(excluding household)

Cash value of life insurance/ annuities

Amounts owed to you

Other assets (Attach listing)

Automobiles (OFFICE USE ONLY)

Non-qualifying portion of primary

dwelling (OFFICE USE ONLY)

Total Assets:

(a) Total Combined Assets of Applicant and Spouse: $ ____________________________________________

If Total Combined Assets exceed $75,000, please complete the following Liabilities section.

(Please complete other side of this form)

Page 3 of 4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4