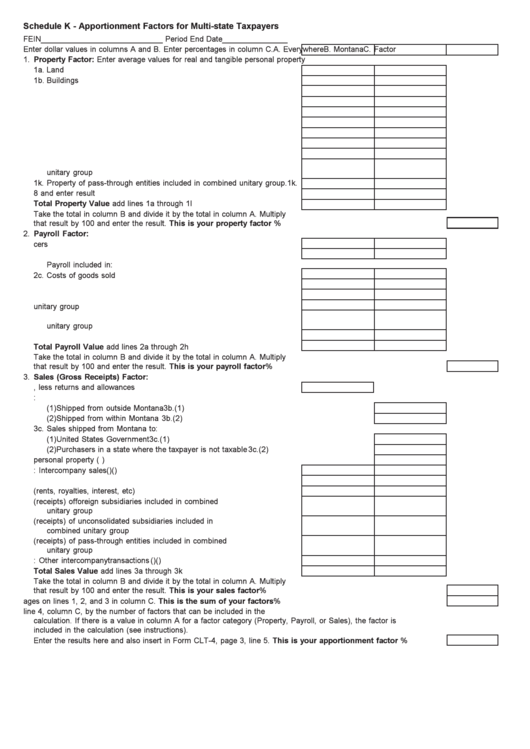

Schedule K - Apportionment Factors for Multi-state Taxpayers

FEIN ____________________________ Period End Date _______________

Enter dollar values in columns A and B. Enter percentages in column C.

A. Everywhere

B. Montana

C. Factor

1. Property Factor: Enter average values for real and tangible personal property

1a. Land ...................................................................................................... 1a.

1b. Buildings ............................................................................................... 1b.

1c. Machinery ............................................................................................... 1c.

1d. Equipment ............................................................................................. 1d.

1e. Furniture and fixtures ............................................................................. 1e.

1f. Leased property ..................................................................................... 1f.

1g. Inventories ............................................................................................. 1g.

1h. Supplies and other ................................................................................ 1h.

1i. Property of foreign subsidiaries included in combined unitary group .... 1i.

1j. Property of unconsolidated subsidiaries included in combined

unitary group ........................................................................................... 1j.

1k. Property of pass-through entities included in combined unitary group . 1k.

1l. Multiply amount of rents by 8 and enter result ....................................... 1l.

Total Property Value add lines 1a through 1l .................................................

Take the total in column B and divide it by the total in column A. Multiply

that result by 100 and enter the result. This is your property factor .......................................................................... 1.

%

2. Payroll Factor:

2a. Compensation of officers ...................................................................... 2a.

2b. Salaries and wages ............................................................................... 2b.

Payroll included in:

2c. Costs of goods sold ............................................................................... 2c.

2d. Repairs .................................................................................................. 2d.

2e. Other deductions .................................................................................... 2e.

2f. Payroll of foreign subsidiaries included in combined unitary group ...... 2f.

2g. Payroll of unconsolidated subsidiaries included in combined

unitary group ......................................................................................... 2g.

2h. Payroll of pass-through entities included in combined unitary group .. 2h.

Total Payroll Value add lines 2a through 2h ...................................................

Take the total in column B and divide it by the total in column A. Multiply

that result by 100 and enter the result. This is your payroll factor ............................................................................. 2.

%

3. Sales (Gross Receipts) Factor:

3a. Gross sales, less returns and allowances ............................................ 3a.

3b. Sales delivered or shipped to Montana purchasers:

(1)

Shipped from outside Montana .................................................................................. 3b.(1)

(2)

Shipped from within Montana .................................................................................... 3b.(2)

3c. Sales shipped from Montana to:

(1)

United States Government ......................................................................................... 3c.(1)

(2)

Purchasers in a state where the taxpayer is not taxable ............................................ 3c.(2)

3d. Sales other than sales of tangible personal property (i.e. service income) ........................... 3d.

3e. Less: Intercompany sales ...................................................................... 3e. (

) (

)

3f. Net gains reported on federal Schedule D and federal Form 4797 ...... 3f.

3g. Other gross receipts (rents, royalties, interest, etc) ............................. 3g.

3h. Sales (receipts) of foreign subsidiaries included in combined

unitary group ......................................................................................... 3h.

3i. Sales (receipts) of unconsolidated subsidiaries included in

combined unitary group .......................................................................... 3i.

3j. Sales (receipts) of pass-through entities included in combined

unitary group ........................................................................................... 3j.

3k. Less: Other intercompany transactions ................................................. 3k. (

) (

)

Total Sales Value add lines 3a through 3k ......................................................

Take the total in column B and divide it by the total in column A. Multiply

that result by 100 and enter the result. This is your sales factor ................................................................................ 3.

%

4. Add the percentages on lines 1, 2, and 3 in column C. This is the sum of your factors ........................................... 4.

%

5. Divide the total percentage on line 4, column C, by the number of factors that can be included in the

calculation. If there is a value in column A for a factor category (Property, Payroll, or Sales), the factor is

included in the calculation (see instructions).

Enter the results here and also insert in Form CLT-4, page 3, line 5. This is your apportionment factor ................ 5.

%

1

1