Page 3

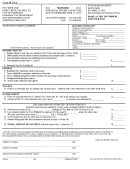

Form 37 (2016)

SUMMARY OF NON W-2 INCOME

Note : Special Rules may apply for S- Corp. distributions.

SCHEDULE J

(For Columns 2-6, Enter City/Village/Township Where Earned)

See RITA Municipalities at

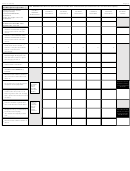

COLUM N 1

P rint the name o f each lo catio n

COLUM N 2

COLUM N 3

COLUM N 4

COLUM N 5

COLUM N 6

COLUM N 7

RESIDENT

(city/village/to wnship) where

LOCA TION 2

LOCA TION 3

LOCA TION 4

LOCA TION 5

LOCA TION 6

TOTA L

M UNICIP A LITY

inco me/lo ss was earned in the

appro priate bo xes.

1 1

1 2

1 3

1 4

1 5

1 6

P le a s e s e e P a ge s 5 - 6 o f t he

Ins t ruc t io ns .

21

22

23

24

25

26

Fro m Federal

23. SCHEDULE C A ttached

31

32

33

34

35

36

Rental Inco me/Lo ss

24. Fro m SCHEDULE E A ttached

41

42

43

44

45

46

Partnership/S-Corp/Trust Income/Loss

25. Fro m SCHEDULE E A ttached

51

52

53

54

55

56

A ll Other Taxable Inco me/Lo ss

26. A ttach Schedule(s)

FOR LINE 28 BELOW:

ADD COLUM NS 1-6,

71

ENTER ON PAGE 2,

(

)

RESIDENT M UNICIP A LITY LOSS

SECTION B, LINE 1b.

27.

CA RRY FORWA RD

61

62

63

64

65

66

CURRENT YEA R WORKP LA CE

INCOM E

28. (To tal Lines 23-27)

72

73

74

75

76

C a lc ula t e t a x due o n wo rk pla c e inc o m e :

(

) (

) (

) (

) (

)

LESS LOSS CA RRY FORWA RD

29.

82

83

84

85

86

NET TA XA B LE WORKP LA CE INCOM E

(Line 28 minus Line 29)

30.

FOR LINE 32 BELOW:

FOR EA CH R IT A M UN IC IP A LIT Y LISTED IN

ADD COLUM NS 2-6,

COLUM NS 2-6 - ENTER THE TA X RA TES.

ENTER ON PAGE 2,

N o t e : If Line 3 0 is le s s t ha n ze ro , do N O T

SECTION B, LINE 11.

e nt e r t a x ra t e .

31 .

M UNICIP A L TA X DUE to EA CH R IT A

M UN IC IP A LIT Y

N o t e : If a m o unt s in C o lum ns 2 - 6 a re $ 10

o r le s s , e nt e r - 0 - . D o N O T inc lude N O N -

R IT A M unic ipa lit ie s .

32.

Note: If you are a resident of a RITA municipality – please go to Page 4 for WORKSHEET L to allocate income/loss and calculate

potential credit for your resident municipality.

SCHEDULE K

.

To complete Schedule K, see page 6 of the instructions. If additional space is needed, use a separate sheet

33.

W-2 WAGES EARNED IN A RITA MUNICIPALITY OTHER THAN YOUR RESIDENCE MUNICIPALITY AND FROM

WHICH NO MUNICIPAL INCOME TAX WAS WITHHELD BY EMPLOYER. Complete lines below.

Tax Rate

Wages

Municipality

(see instructions)

Tax Due

Add Tax Due Column, enter total here AND on Page 2, Section B, Line 10.

33. ______________

34.

W-2 WAGES EARNED IN A NON-RITA TAXING MUNICIPALITY AND FROM WHICH NO MUNICIPAL INCOME TAX

WAS WITHHELD BY EMPLOYER. ONLY USE THIS SECTION IF YOU HAVE FILED AND PAID THE TAX DUE TO

YOUR WORKPLACE MUNICIPALITY. PROOF OF PAYMENT MAY BE REQUIRED. Complete lines below.

Tax Rate

Wages

Municipality

(see instructions)

Tax Due

Add Tax Due Column, enter total here.

34. ______________

ENTER the amount from WORKSHEET L, Row 9, Column 7.

35. ______________

Add Lines 33-35. Enter total on Page 2, Section B, Line 4b.

36. ______________

1

1 2

2 3

3 4

4