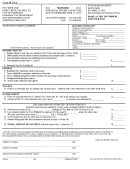

Form 37 (2016)

Page 4

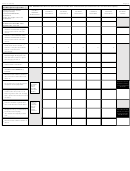

WORKSHEET L

RITA RESIDENTS ONLY Use this to allocate income/loss and calculate potential credit for resident municipality.

INCOME/LOSS ALLOCATION

P rint the name o f each lo catio n

COLUM N 1

COLUM N 2

COLUM N 3

COLUM N 4

COLUM N 5

COLUM N 6

COLUM N 7

(city/village/to wnship)

RESIDENT

LOCA TION 2

LOCA TION 3

LOCA TION 4

LOCA TION 5

LOCA TION 6

TOTA LS

listed f ro m S C H E D ULE J ,

M UNICIP A LITY

COLUM NS 1 -6

P le a s e s e e P a ge s 5 - 6 o f t he

Ins t ruc t io ns .

Enter CURRENT Y EAR

WO RKP LACE INCO ME From

S CHEDULE J, Line 2 8

Columns 1- 6: If CURRENT YEAR

WORKPLACE INCOME is a ga in ,

1.

enter in each column and total

across.

Columns 1- 6: If CURRENT YEAR

WORKPLACE INCOME is a loss ,

2.

enter in each column and total

across.

Compute G AIN P e rc e nta ge :

Divide each amount in Row 1,

%

%

%

%

%

%

3.

Columns 1- 6 by the total in Row 1,

Column 7 and enter the

percentage.

Alloc a te Tota l Loss by G AIN

P e rc e nta ge : Multiply the total

4.

loss from Row 2, Column 7 by the

percentage(s) in Row 3.

5.

Subtract Row 4 from Row 1.

Enter NET TAXABLE WORKPLACE

INCOME from S CHEDULE J,

6.

Line 3 0 .

Enter the lesser of Row 5 or Row 6

7.

above. If amount is less than zero,

enter - 0- .

Enter amo unt fro m

Rows 8-9:

For Columns 2- 6, enter tax rate for

Ro w 9, Co l 7 belo w

8.

Calculate

workplace municipality listed.

o n P age 3, Schedule

the tax

due on

K, Line 35

Non-W2

Multiply Row 6 by Row 8. If the

workplace

income

result is $10 or less, enter - 0- on

9.

Row 9. If greater than $10 - multiply

Row 7 by Row 8 and enter the result

on Row 9.

Rows 10-

If amount in Row 9 is greater than

10.

11: Get

zero, enter the amount from Row 7.

credit f or

the tax

paid in

Row 9,

Multiply Row 10 by the Credit Rate of

Enter amo unt fro m

Column 7

the resident municipality.

Ro w 1 2, Co l 7 belo w

11.

The resident municipality's credit

o n P age 2, Credit

Rate Wo rksheet

rate: ________

Enter the lesser of Row 9 or Row 11

12.

above.

1

1 2

2 3

3 4

4