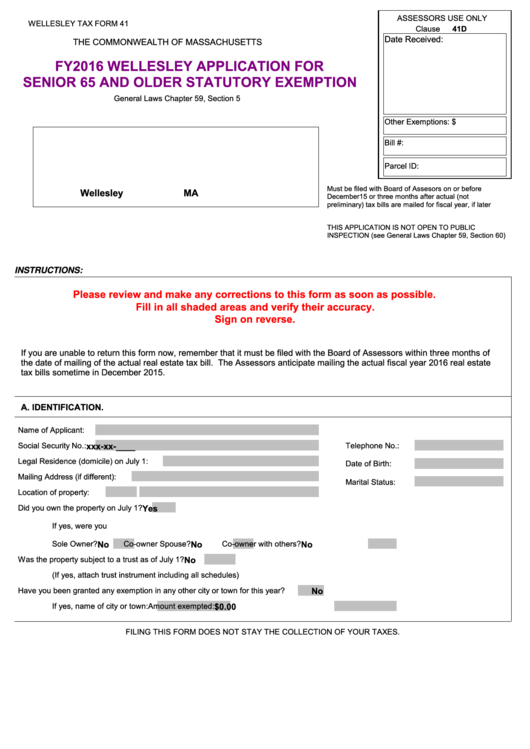

Form 41 - Fy2016 Wellesley Application For Senior 65 And Older Statutory Exemption

ADVERTISEMENT

ASSESSORS USE ONLY

WELLESLEY TAX FORM 41

Clause

41D

Date Received:

THE COMMONWEALTH OF MASSACHUSETTS

FY2016 WELLESLEY APPLICATION FOR

SENIOR 65 AND OLDER STATUTORY EXEMPTION

General Laws Chapter 59, Section 5

Other Exemptions: $

Bill #:

Parcel ID:

Must be filed with Board of Assesors on or before

Wellesley

MA

December15 or three months after actual (not

preliminary) tax bills are mailed for fiscal year, if later

THIS APPLICATION IS NOT OPEN TO PUBLIC

INSPECTION (see General Laws Chapter 59, Section 60)

INSTRUCTIONS:

Please review and make any corrections to this form as soon as possible.

Fill in all shaded areas and verify their accuracy.

Sign on reverse.

If you are unable to return this form now, remember that it must be filed with the Board of Assessors within three months of

the date of mailing of the actual real estate tax bill. The Assessors anticipate mailing the actual fiscal year 2016 real estate

tax bills sometime in December 2015.

A. IDENTIFICATION.

Name of Applicant:

Social Security No.:

xxx-xx-____

Telephone No.:

Legal Residence (domicile) on July 1:

Date of Birth:

Mailing Address (if different):

Marital Status:

Location of property:

Did you own the property on July 1?

Yes

If yes, were you

Sole Owner?

No

Co-owner Spouse?

No

Co-owner with others?

No

Was the property subject to a trust as of July 1?

No

(If yes, attach trust instrument including all schedules)

Have you been granted any exemption in any other city or town for this year?

No

If yes, name of city or town:

Amount exempted:

$0.00

FILING THIS FORM DOES NOT STAY THE COLLECTION OF YOUR TAXES.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2