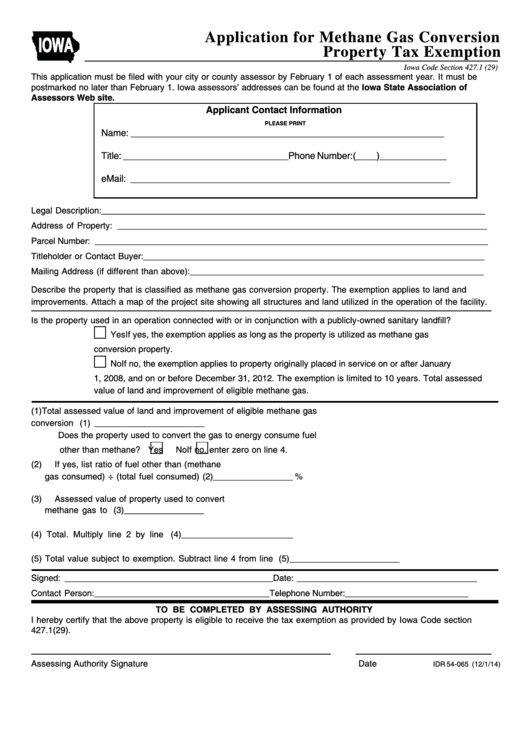

Form Idr 54-065 - Application For Methane Gas Conversion Property Tax Exemption

ADVERTISEMENT

Application for Methane Gas Conversion

IOWA

Property Tax Exemption

Iowa Code Section 427.1 (29)

This application must be filed with your city or county assessor by February 1 of each assessment year. It must be

postmarked no later than February 1. Iowa assessors’ addresses can be found at the Iowa State Association of

Assessors Web site.

Applicant Contact Information

PLEASE PRINT

Name: _____________________________________________________________

Title: ________________________________Phone Number:(____)_____________

eMail: ______________________________________________________________

Legal Description: _________________________________________________________________________________

Address of Property: ______________________________________________________________________________

Parcel Number: ____________________________________________________________________________________

Titleholder or Contact Buyer: ________________________________________________________________________

Mailing Address (if different than above): ______________________________________________________________

Describe the property that is classified as methane gas conversion property. The exemption applies to land and

improvements. Attach a map of the project site showing all structures and land utilized in the operation of the facility.

Is the property used in an operation connected with or in conjunction with a publicly-owned sanitary landfill?

Yes

If yes, the exemption applies as long as the property is utilized as methane gas

conversion property.

No

If no, the exemption applies to property originally placed in service on or after January

1, 2008, and on or before December 31, 2012. The exemption is limited to 10 years. Total assessed

value of land and improvement of eligible methane gas.

(1)

Total assessed value of land and improvement of eligible methane gas

conversion property........................................................................................ (1) _______________________

Does the property used to convert the gas to energy consume fuel

other than methane?

Yes

No If no, enter zero on line 4.

(2)

If yes, list ratio of fuel other than (methane

gas consumed) ÷ (total fuel consumed)...............(2)_________________ %

(3)

Assessed value of property used to convert

methane gas to energy....................................... (3)_________________

(4) Total. Multiply line 2 by line 3.............................................................................(4)________________________

(5) Total value subject to exemption. Subtract line 4 from line 1..................................(5)_______________________

Signed: ____________________________________________ Date: ______________________________________

Contact Person: _____________________________________ Telephone Number: __________________________

TO BE COMPLETED BY ASSESSING AUTHORITY

I hereby certify that the above property is eligible to receive the tax exemption as provided by Iowa Code section

427.1(29).

Assessing Authority Signature

Date

IDR 54-065 (12/1/14)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1