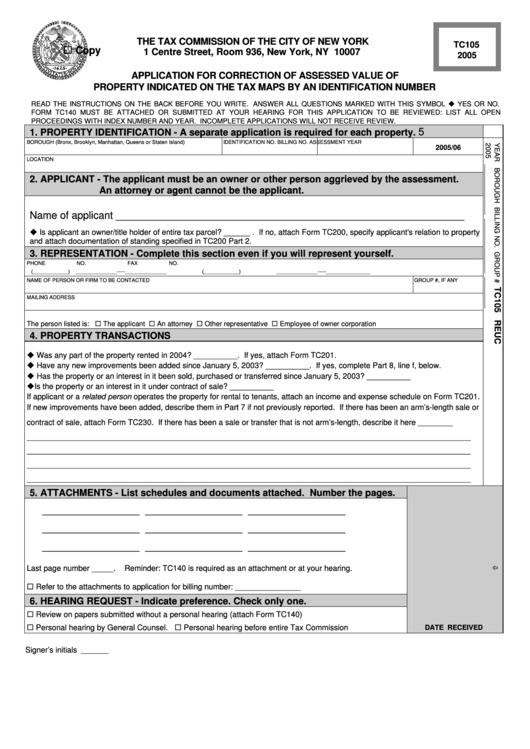

Form Tc105 - Application For Correction Of Assessed Value Of Property Indicated On The Tax Maps By An Identification Number - 2005

ADVERTISEMENT

THE TAX COMMISSION OF THE CITY OF NEW YORK

TC105

Copy

1 Centre Street, Room 936, New York, NY 10007

2005

APPLICATION FOR CORRECTION OF ASSESSED VALUE OF

PROPERTY INDICATED ON THE TAX MAPS BY AN IDENTIFICATION NUMBER

READ THE INSTRUCTIONS ON THE BACK BEFORE YOU WRITE. ANSWER ALL QUESTIONS MARKED WITH THIS SYMBOL

YES OR NO.

FORM TC140 MUST BE ATTACHED OR SUBMITTED AT YOUR HEARING FOR THIS APPLICATION TO BE REVIEWED: LIST ALL OPEN

PROCEEDINGS WITH INDEX NUMBER AND YEAR. INCOMPLETE APPLICATIONS WILL NOT RECEIVE REVIEW.

5

1. PROPERTY IDENTIFICATION - A separate application is required for each property.

BOROUGH (Bronx, Brooklyn, Manhattan, Queens or Staten Island)

IDENTIFICATION NO.

BILLING NO.

ASSESSMENT YEAR

2005/06

LOCATION

2. APPLICANT - The applicant must be an owner or other person aggrieved by the assessment.

An attorney or agent cannot be the applicant.

Name of applicant _____________________________________________________________

Is applicant an owner/title holder of entire tax parcel? ______ . If no, attach Form TC200, specify applicant's relation to property

and attach documentation of standing specified in TC200 Part 2.

3. REPRESENTATION - Complete this section even if you will represent yourself.

PHONE NO.

FAX NO.

(____________)

______________-----______________

(____________)

______________-----_______________

NAME OF PERSON OR FIRM TO BE CONTACTED

GROUP #, IF ANY

MAILING ADDRESS

The person listed is:

The applicant

An attorney

Other representative

Employee of owner corporation

4. PROPERTY TRANSACTIONS

Was any part of the property rented in 2004? __________. If yes, attach Form TC201.

Have any new improvements been added since January 5, 2003? __________. If yes, complete Part 8, line f, below.

Has the property or an interest in it been sold, purchased or transferred since January 5, 2003? __________

Is the property or an interest in it under contract of sale? __________

If applicant or a related person operates the property for rental to tenants, attach an income and expense schedule on Form TC201.

If new improvements have been added, describe them in Part 7 if not previously reported. If there has been an arm’s-length sale or

contract of sale, attach Form TC230. If there has been a sale or transfer that is not arm’s-length, describe it here

_________

__________________________________________________________________________________________________________________

__________________________________________________________________________________________________________________

__________________________________________________________________________________________________________________

__________________________________________________________________________________________________________________

5. ATTACHMENTS - List schedules and documents attached. Number the pages.

_________________

_________________

_________________

_________________

_________________

_________________

_________________

_________________

_________________

Last page number _____.

Reminder: TC140 is required as an attachment or at your hearing.

Refer to the attachments to application for billing number: _______________

6. HEARING REQUEST - Indicate preference. Check only one.

Review on papers submitted without a personal hearing (attach Form TC140)

Personal hearing by General Counsel.

Personal hearing before entire Tax Commission

DATE RECEIVED

Signer’s initials

_______

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2