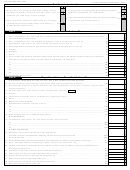

Form 480.70(Oe) - Informative Return For Income Tax Exempt Organizations - Puerto Rico Department Of The Treasury Page 3

ADVERTISEMENT

Income Tax Exempt Organizations - Page 3

Form 480.70(OE) Rev. 05.00

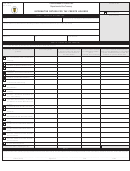

Balance Sheet

Part IV

Beginning of the year

Ending of the year

Total

Total

Assets

1.

Cash .....................................................................

00

00

(1)

2.

Notes and accounts receivable ............................

00

00

(2)

(

)

(

)

Less: Reserve for bad debts....................... ........

00

00

00

00

3.

Inventories ...........................................................

00

00

(3)

4.

Investments in governmental obligations ...............

00

00

(4)

5.

Investments in non-governmental funds ................

00

00

(5)

6.

Investments in corporate stocks (see instructions

Part IV) ..................................................................

00

00

(6)

7.

Other investments (submit detail) ........................

00

00

(7)

8.

Capital assets

(a) Depreciable or depletable assets

(submit itemized schedule) .................................

00

00

(8a)

(

)

(

)

Less: Reserve for depreciation (or depletion)

00

00

00

00

(b) Land ..............................................................

00

00

(8b)

9.

Other assets (itemize) .......................................

00

00

(9)

10.

Total Assets .......................................................

00

00

(10)

Liabilities

11.

Accounts payable ..................................................

00

00

(11)

12.

Bonds, notes and mortgages payable

(a) with original maturity date of less than 1 year....

00

00

(12a)

(b) with original maturity date of 1 year or more .....

00

00

(12b)

13.

Other liabilities (submit detail) ..............................

00

00

(13)

14.

Total Liabilities ..................................................

00

00

(14)

Stockholder's Equity

15.

Capital stock

(a) Preferred stocks ..........................................

00

00

(15a)

(b) Common stocks .............................................

00

00

(15b)

16.

Membership certificates .....................................

00

00

(16)

17.

Paid-in capital or capital surplus (donated capital

if a trust) ................................................................

00

00

(17)

18.

Surplus reserves (itemize) ..................................

00

00

(18)

19.

Earned surplus and undivided profits ..........................

00

00

(19)

20.

Total Stockholder's Equity ...............................

00

00

(20)

21.

Total Liabilities and Stockholder's Equity ........

(21)

00

00

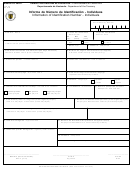

Part V

List of Officials, Directors or Employees Who Occupy Key Positions

Contributions to

Number

of

Allowances or

pension plans or

weekly hours

Social Security Number

Name and title

Compensation

expenses

deferred

dedicated to

account

compensation

the institution

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5