Form Il-2220 - Instructions - Illinois Department Of Revenue - 2014 Page 2

ADVERTISEMENT

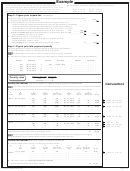

Line 11 —

If all or a portion of your overpayment results from

payments made after the due date of your first estimated tax

•

Gambling withholding: If you received a Form W-2G, Gambling

installment, that portion of your credit is considered to be paid

Withholding, include the amount of withholding in four equal

on the date you made the payment

installments.

.

—

•

Pass-through withholding payments: If you received an Illinois

For all other tax types - on the original due date of the

Schedule K-1-P or K-1-T showing pass-through withholding

current year return.

payments made on your behalf, enter the entire amount in the quarter

•

after the extended due date of that prior year return, your

in which the pass-through entity’s tax year ended.

credit is considered to be paid

For example, if your tax year ended on March 31, 2015, and your

—

For corporations (excluding S corporations) - on the date

Schedule K-1-P shows a tax year ending of June 30, 2014, you

you filed the return on which you made the election.

would put the pass-through withholding payment amount in Quarter 1.

—

For all other tax types - on the original due date of the

Line 12 —

Quarters 1 through 4 — Subtract Line 11 from Line 10 and

current year return, or on the date you file the return on

enter that amount here. If this amount is negative, use brackets. If Line 11

which you made the election, whichever is later.

is blank or zero, enter the amount from Line 10.

Example 1: Filing on or before the extended due date of the

Lines 13 and 14 —

Complete Lines 13 and 14 of each quarter before

prior year return and making timely payments

proceeding to the next quarter. Follow the instructions on the form.

You filed your

•

For corporations (excluding S corporations) -

Step 3: Figure your unpaid tax

2013 Form IL-1120 calendar year return on or before the

extended due date of that return requesting $500 be applied

Line 15 —

Enter the total from:

against estimated tax. All of your payments were made before

• Form IL-1120, Step 8, Line 53;

the original due date of your return. Your credit of $500 will be

• Form IL-1120-ST, Step 8, Line 59;

considered to be paid on April 15, 2014.

• Form IL-1065, Step 8, Line 60;

• Form IL-1041, Step 7, Line 51; or

In this case, enter $500 and a date paid of April 15, 2014, on

.

• Form IL-990-T, Step 6, Line 27

Line 18.

Line 16a —

Enter the total of all payments you made on or before the

You filed your 2013 Form IL-1065

•

For all other tax types -

original due date of your tax return. Include any overpayment credit(s)

calendar year return on or before the extended due date of

carried forward to 2014 from a prior year original or amended return if

that return requesting $500 be applied against estimated tax.

the prior year return was filed on or before the original due date of your

All of your payments were made before the original due date

2014 return. You must also include withholding (including gambling

of your return. Your credit of $500 will be considered to be

withholding), estimated payments (Form IL-1120-ES) or voluntary

paid on April 15, 2015.

prepayments (Form IL-516-I or Form IL-516-B), extension payments

(Form IL-505-B), pass-through withholding payments made on your

In this case, enter $500 and a date paid of April 15, 2015, on

behalf, payments made with a voucher generated by a software

Line 18.

program, electronic payments, and payments made with your tax

Example 2: Filing on or before the extended due date of the

return or “V” vouchers.

prior year return and making late payments

Line 16b —

Form IL-1120 filers only: Add the amounts from Step 2,

•

For corporations (excluding S corporations) -

You filed your

Line 10, all Columns. Enter the result on Line 16b. All other filers, enter

2013 Form IL-1120 calendar year return on or before the

zero.

extended due date of that return requesting $500 be applied

Line 16 —

Enter the greater of 16a or 16b.

against estimated tax. Your overpayment includes payments

Line 17 —

S

ubtract Line 16 from Line 15. If the amount is

of $400 you made before the original due date of your return,

and a $100 payment you made on July 1, 2014. A credit of

• positive, enter the amount here. You owe a late-payment

$400 will be considered to be paid on April 15, 2014. The

penalty for unpaid tax. Continue to Step 4 and enter this

amount in Penalty Worksheet 2, Column C, Line 21.

remaining $100 credit will be considered to be paid on July 1,

2014.

• zero or negative, enter the amount here. If the result is negative,

use brackets.

In this case, you will enter two credits on Line 18. One for

Step 4: Figure your late-payment penalty

$400 reporting a date paid of April 15, 2014, and another for

$100 reporting a date paid of July 1, 2014.

Use:

to figure your late payment penalty for:

•

For all other tax types -

You filed your 2013 Form IL-1065

• Penalty Worksheet 1

underpayment of estimated tax.

calendar year return on or before the extended due date of

• Penalty Worksheet 2

unpaid tax.

that return requesting $500 be applied against estimated

You must follow the instructions in order to properly complete

tax. Your overpayment includes payments of $400 you made

the penalty worksheets.

before the original due date of your return, and a $100

Line 18 —

Enter your payments, regardless of the type of payment, and

payment you made on July 1, 2014. A credit of $500 will be

the date you made the payment. List the payments in date order. Include

considered to be paid on April 15, 2015.

any overpayment credit(s) carried forward from a prior year original or

In this case, enter $500 and a date paid of April 15, 2015, on

amended return. If your prior year return that made the election to credit

Line 18.

your overpayment against your 2014 tax was filed

•

on or before the extended due date of that prior year return,

your credit is considered to be paid

—

For corporations (excluding S corporations) - on the due

date of your first estimated tax installment.

IL-2220 Instructions (R-12/14)

Page 2 of 5

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5