Form Il-2220 - Instructions - Illinois Department Of Revenue - 2014 Page 3

ADVERTISEMENT

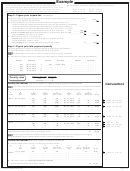

Example 3: Filing after the extended due date of the prior

If you entered “0” in Column D, enter the amount from Column C here,

and complete Columns F through I.

year return

Column F —

Enter the date the payment in Column D was made. If

•

For corporations (excluding S corporations) -

You filed your

Column D is “0,” do not enter a date and skip to Column H.

2013 Form IL-1120 calendar year return on December 1,

2014, requesting $500 be applied against estimated tax. Your

Column G —

Figure the number of days from the date in Column B to

credit of $500 will be considered to be paid on December 1,

the date in Column F and enter that number here. This is the number of

2014, because you filed your return after the extended due

days the payment was late.

date of your 2013 calendar year return.

Column H —

Enter the penalty rate that applies to the number of days

In this case, enter $500 and a date paid of December 1,

you entered in Column G. See the penalty rates listed on Form IL-2220,

Page 2, above Penalty Worksheet 1.

2014, on Line 18.

If Column D is “0,” enter 10 percent (.10).

•

For all other tax types -

You filed your 2013 Form IL-1065

calendar year return on December 1, 2014, requesting $500

Column I —

Figure this amount using the payment portion in either

be applied against estimated tax. Your credit of $500 will be

Column C or Column D.

considered to be paid on April 15, 2015, because the original

If Column D is “0” or if Column E is “0” or a negative figure, multiply

due date of the current year return, April 15, 2015, is later

Column C by Column H and enter the amount here. Otherwise, multiply

than the date you filed the return making the election.

Column D by Column H and enter the amount here.

In this case, enter $500 and a date paid of April 15, 2015, on

Line 20 —

Add Column I, Quarters 1 through 4. This is your late-

Line 18.

payment penalty for underpayment of estimated tax. Enter the total

amount here and on Form IL-1120, Step 8, Line 54.

If you do not complete Penalty Worksheet 1, only enter

payments made and credits received after the original due date of your

Penalty Worksheet 2 — Late-payment penalty for

tax return.

unpaid tax

Do not include income tax credits, withholding, or pass-through

Line 21 —

withholding payments made on your behalf.

Column B —

Enter the original due date of your return.

Penalty Worksheet 1 — Late-payment penalty for

Column C —

Enter the amount from Line 17.

underpayment of estimated tax

(Form IL-1120 filers only)

Column D —

If you completed Penalty Worksheet 1, and you have

If the amount on Line 14 is positive (greater than zero) for any quarter,

a negative amount (overpayment ) in Column E of the 4th quarter, and

you may owe a late payment penalty for underpayment of estimated

the payment date in Column F is after the original due date of your tax

tax. Use this worksheet to figure the penalty for any unpaid quarter.

return, you may apply the overpayment from Line 19, Column E, as the

If you paid the required amount from Line 14 by the due date on

first available payment for Line 21, Column D.

Line 9 for each quarter, do not complete Penalty Worksheet 1.

Continue applying unused payments received after the original due date

Line 19 —

of your tax return from Line 18, in date order until the unpaid amount in

Column C has been satisfied (Column E is zero or a negative figure).

Column C —

Enter

the underpaid amount from Line 14 on the first

line of the appropriate quarter. Do not enter any overpaid amounts in this

If you did not complete Penalty Worksheet 1, apply payments received

column.

after the original due date of your tax return from Line 18, in date order

until the unpaid amount in Column C has been satisfied (Column E is

Column D —

Apply to the first unpaid quarter, the payment from

zero or a negative figure).

Line 18 with the earliest payment date.

If you have no more payments to apply and Column C remains unpaid,

Continue applying payments in date order until all unpaid amounts in

enter “0” in Column D and complete Columns E through I.

Column C have been satisfied (Column E is zero or a negative figure for

all unpaid quarters) or you have no more payments to apply.

See the example on the final page of these instructions.

For quarters two through four: If you have an overpayment available

Complete Columns E through I

from the previous quarter (quarters one through three, respectively) in

Column E —

Subtract the payment in Column D from the unpaid

Column E, you may use that amount for the first available payment in the

amount in Column C.

current quarter.

If this amount is

See the example on the final page of these instructions.

• positive, complete Columns F through I. Enter this positive (unpaid)

Column E —

Subtract the payment in Column D from the unpaid

amount on the next line in Column C. Continue applying payments

amount in Column C.

in date order until Column E is an overpayment, zero, or you have

entered “0” in Column D.

If this amount is

• zero or negative, you have paid your tax. Enter the amount

• positive, complete Columns F through I. Enter this positive (unpaid)

here and, if negative, use brackets. Complete Columns F through I.

amount on the next line in Column C. Continue applying payments

in date order until the unpaid amount in Column C has been

If you entered “0” in Column D, enter the amount from Column C here,

and complete Columns F through I.

satisfied (Column E is a negative figure, zero, or you entered “0” in

Column D).

Column F —

Enter the date of the payment you applied in Column D. If

• zero or negative, you have paid your tax. Enter the amount here

• you are applying an overpayment from Penalty Worksheet 1,

and, if negative, use brackets. Complete columns F through I.

Column E, enter the date that corresponds to that payment, shown

on Line 18.

If this amount is negative in the 4th quarter, and the payment

date in Column F is after the original due date of the return, apply

• Column D is “0,” do not enter a date in Column F and skip to

this overpayment to any unpaid tax shown on Penalty Worksheet 2,

Column H.

Line 21 when figuring your late payment penalty for unpaid tax. See

the instructions for Penalty Worksheet 2, Column D.

Page 3 of 5

IL-2220 Instructions (R-12/14)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5