Form Il-2220 Instructions - Illinois Department Of Revenue - 2016 Page 5

ADVERTISEMENT

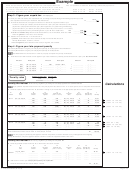

Example

ABC Corporation’s total Illinois net income and replacement tax

The corporation made the following estimated payments:

and surcharge is $1,875, as shown on its 2016 Form IL-1120, Step

8, Line 57. The 2015 tax was $2,600. The corporation filed Form

$100 4-15-16

$750

9-15-16

IL-1120 on September 4, 2017, and paid $300 with the return.

$200 6-17-16

$250 12-19-16

Step 3: Figure your unpaid tax

-

all taxpayers

17 Enter your total net income and replacement tax, surcharge, and pass-through withholding payments you owed

1875

17 ____________ 00

and reported on behalf of your members. See instructions.

18 a Enter the total amount of all payments made on or before the original due date of your

tax return. Include your credit(s) carried forward from a prior year (see instructions), total estimated

payments or prepayments made this year, 505-B payments, any pass-through withholding

payments made on your behalf, annual payments made with your tax return or “V” vouchers,

1300

electronic payments, and any withholding shown on your W-2G or 1099 forms.

18a

____________ 00

1688

b Form IL-1120 filers only: Enter the total of all Columns, Line 12. All others, enter zero. 18b

____________ 00

1688

Enter the greater of Line 18a or Line 18b here.

18 ____________ 00

19 Subtract Line 18 from Line 17. If this amount is

—positive, enter that amount here. Continue to Step 4 and enter this amount in

Penalty Worksheet 2, Column C, Line 23.

187

—zero or negative, enter that amount here and, if negative, use brackets.

19 ____________ 00

Step 4: Figure your late-payment penalty

Use Penalty Worksheet 1 to figure your late-payment penalty for underpayment of estimated tax.

Use Penalty Worksheet 2 to figure your late-payment penalty for underpaid tax.

You must follow the instructions in order to properly complete the penalty worksheets.

20

Enter the amount and the date of each payment you made. Include any credit(s) carried forward from a prior year. See instructions.

Amount

Date paid

Amount

Date paid

Amount

Date paid

100

04 15 2016

300

09 04 2017

a

e

i

____________

_ _/_ _/_ _ _ _

____________

_ _/_ _/_ _ _ _

____________

_ _/_ _/_ _ _ _

200

06 17 2016

b

_ _/_ _/_ _ _ _

f

_ _/_ _/_ _ _ _

j

_ _/_ _/_ _ _ _

____________

____________

____________

750

09 15 2016

c

g

k

____________

_ _/_ _/_ _ _ _

____________

_ _/_ _/_ _ _ _

____________

_ _/_ _/_ _ _ _

250

12 19 2016

d

_ _/_ _/_ _ _ _

h

_ _/_ _/_ _ _ _

l

_ _/_ _/_ _ _ _

____________

____________

____________

Number of days late

Penalty rate

Penalty rates

1 - 30 ........................... .02

31 or more ...................... .10

Penalty Worksheet 1 —

Late-payment penalty for underpayment of estimated tax

Calculations

If you paid the required amount from Line 16 by the payment due date on Line 11 for each quarter, do not complete this worksheet.

21

Enter the unpaid amounts from Line 16, Quarters 1 through 4, on the first line of the appropriate quarters in Column C below.

A

B

C

D

E

F

G

H

I

Due

Unpaid

Payment

Balance due

Payment

No. of

Penalty rate

Period

date

amount

applied

(Col. C - Col. D)

date

days late

(see above)

Penalty

04 18 2016

422

100

322

04 15

2016

0

0

0.00

_ _/_ _/_ _ _ _

__________

__________

__________

_ _/_ _/_ _ _ _

_____

__________ ______

Qtr. 1

322

200

122

06 17

2016

60

.10

20.00

(200 x .10 = 20.00)

__________

__________

__________

_ _/_ _/_ _ _ _

_____

__________ ______

122

750

(628)

09 15

2016

150

.10

12.20

__________

__________

__________

_ _/_ _/_ _ _ _

_____

__________ ______

(122 x .10 = 12.20)

06 15 2016

422

628

(206)

09 15

2016

92

.10

42.20

(422 x .10 = 42.20)

_ _/_ _/_ _ _ _

__________

__________

__________

_ _/_ _/_ _ _ _

_____

__________ ______

Qtr. 2

__________

__________

__________

_ _/_ _/_ _ _ _

_____

__________ ______

__________

__________

__________

_ _/_ _/_ _ _ _

_____

__________ ______

09 15 2016

422

206

216

09 15

2016

0

0

0.00

_ _/_ _/_ _ _ _

__________

__________

__________

_ _/_ _/_ _ _ _

_____

__________ ______

Qtr. 3

(216 x .10 = 21.60)

216

250

(34)

12 19

2016

95

.10

21.60

__________

__________

__________

_ _/_ _/_ _ _ _

_____

__________ ______

__________

__________

__________

_ _/_ _/_ _ _ _

_____

__________ ______

12 15 2016

422

34

388

12 19

2016

4

.02

.68

(34 x .02 = .68)

_ _/_ _/_ _ _ _

__________

__________

__________

_ _/_ _/_ _ _ _

_____

__________ ______

Qtr. 4

388

300

88

09 04

2017

263

.10

30.00

(300 x .10 = 30.00)

__________

__________

__________

_ _/_ _/_ _ _ _

_____

__________ ______

88

0

88

.10

8.80

__________

__________

__________

_ _/_ _/_ _ _ _

_____

__________ ______

(88 x .10 = 8.80)

22

Add Column I, Quarters 1 through 4. This is your late-payment penalty for underpayment of estimated tax.

135.48

22 __________

Enter the total amount here and on Form IL-1120, Step 8, Line 58.

You may apply any remaining overpayment from the 4th quarter, in Column E above to any underpayment when figuring

Penalty Worksheet 2, only if the payment date in Column F is after the original due date of the return.

Penalty Worksheet 2 —

Late-payment penalty for unpaid tax

23

Enter any positive amount from Line 19 on the first line of Column C below.

A

B

C

D

E

F

G

H

I

Due

Unpaid

Payment

Balance due

Payment

No. of

Penalty rate

date

amount

applied

(Col. C - Col. D)

date

days late (see above)

Penalty

04 18 2017

187

0

187

.10

18.70

(187 x .10 = 18.70)

_ _/_ _/_ _ _ _

__________

__________

__________

_ _/_ _/_ _ _ _

_____

_____

__________

Return

__________

__________

__________

_ _/_ _/_ _ _ _

_____

_____

__________

__________

__________

__________

_ _/_ _/_ _ _ _

_____

_____

__________

__________

__________

__________

_ _/_ _/_ _ _ _

_____

_____

__________

24

Add Column I. This is your late-payment penalty for unpaid tax.

18.70

24 __________

Enter the total amount here and on Step 5, Line 28.

Page 5 of 5

IL-2220 Instructions (R-12/16)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5