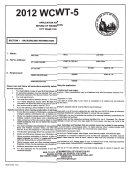

APPLICATION FOR REFUND OF STATE TAXES

AP-186 -2

b

(11-98/2)

PAID BY PERSON OWNING

CERTAIN ABATED PROPERTY

PLEASE PRINT OR TYPE. DO NOT WRITE IN SHADED AREAS.

(SEE PAGE 1 FOR COMPLETE INSTRUCTIONS.)

Step 1:

54100

a

TCode

e

Tax Year Subject of Claim

Owner’s Name,

ID Number

c

Taxpayer/Employer ID Number

and Address.

f Blacken this box if your address has changed:

1 FM

d

Taxpayer Name and Mailing Address:

g (For Comptroller use only)

2 ATT

mo.

day

year

3 SD

PM

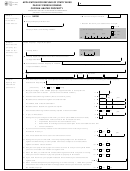

Step 2:

Abated Property: Legal Description

Describe the

h

property (as

listed on tax

i

County Name

ia. County Code

bill and/or tax

receipt).

j

County Appraisal District Parcel Identification Number

on Appraisal Roll:

k

School District in Which Property is Located:

Independent School District (ISD)

.

l

Physical Address (Street)

m. City

n. State

o. Zip Code

_

Step 3:

p. With what city or county did you originate the abatement agreement under Chapter 312, concerning the abated property

Specify the

described in Step 2? p

abatement

1

2

provisions.

(check one)

q

city or

county

r1. What percentage of the abated property’s appraised value is exempt for the

tax year claimed in e above? (round to nearest whole number)

r1

%

years

r2. Period of abatement agreement (Not to exceed 10 years)

r2

mo.

day

year

s. What date was abatement agreement entered into?

s

mo.

day

year

t.

If modified, date of last modification?

t

mo.

day

year

u. What date does abatement agreement expire?

u

1

2

v.

Has the abatement agreement already expired or been canceled?

v

yes

no

mo.

day

year

w. If yes, on what date?

w

x. During the tax year subject to this claim, you have: (enter one of these numbers)

x

1 - established a new business in the reinvestment zone,

2 - expanded a business in the reinvestment zone,

3 - modernized an existing business to retain jobs in this reinvestment zone OR

4 - none of the above.

y.

Is your business currently located in the reinvestment zone in the city or county

1

2

referenced in item p?

y

yes

no

mo.

day

year

z. If no, what date did it move out of the reinvestment zone?

z

aa. During the tax year of this claim, was the property subject to a tax abatement

agreement with the city or county listed above also subject to a tax abatement

1

2

agreement with a school district?

aa

yes

no

bb. Has your company made a payment “in lieu of taxes” to a city or county with which

1

2

you have executed a tax abatement agreement?

bb

yes

no

cc. Since the date you entered into an abatement agreement with a city and/or county,

1

2

have you had an increase in payroll, specific to property in this state?

cc

yes

no

dd. If yes, how much has your payroll increased since the date you entered into the

agreement?

dd

$

ee. Since an initial comparison year beginning on or after January 1, 1996, have you had

an increase of at least $4 million in the appraised value of your business, specific to

1

2

the abated property?

ee

yes

no

1

1 2

2 3

3