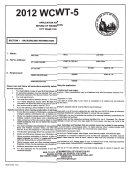

APPLICATION FOR REFUND OF STATE TAXES

AP-186-3

(11-98/2)

PAID BY PERSON OWNING

CERTAIN ABATED PROPERTY

PLEASE PRINT OR TYPE. DO NOT WRITE IN SHADED AREAS.

(SEE PAGE 1 FOR COMPLETE INSTRUCTIONS.)

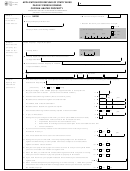

Step 4:

1a. Total appraised value of property for this claim year subject

to abatement agreement listed in Step 3.

1a

$

Specify the

requested

1b. Initial base comparison year appraised value of property

subject to abatement agreement listed in Step 3.

1b

$

refund amount.

1c. Value after initial base comparison year deduction. (Item 1a

minus Item 1b should equal Item 1c.)

1c

$

1d. Abatement agreement value that would not have been

subject to school district property tax had you been in the

abatement agreement listed in Step 3. (Multiply Item 1c

by Item r1.)

1d

$

per $100 of value

2. School tax rate as shown on tax bill.

2

$

•

3. Potential refund amount of property tax that would NOT

have been paid on property subject to abatement agreement

listed in Step 3. (Maximum actual refund amount is limited

to net state sales and use tax and franchise tax paid in the

calendar year subject to the claim (see Item e) and may also

be limited by a statutory statewide refund ceiling amount.)

(Multiply Item 1d by Item 2, then multiply the result by .01.)

3

$

•

4. Amount of property tax paid to the school district as shown

on your tax receipt.

4

$

•

The following documents must accompany this refund request:

Step 5:

1. copy of tax receipt from the school district;

Attach

2. copy of the tax abatement agreement(s);

requested

3. a signed statement from the county appraisal district’s chief appraiser verifying that an exemption from property

documents.

tax was granted and showing the current appraised value, and initial base comparison year’s appraised value

of the property subject to the abatement agreement described in Step 3;

4. a statement from each applicable city or county official verifying that the abatement agreement

has been filed with the state entity responsible for maintaining a registry of tax abatements;

5. copies of Texas Workforce Commission returns for the calendar year the agreement was entered into and the calendar

year subject to this claim, showing an increase in payroll since entering into the abatement agreement (if you checked

“yes” on Item cc and entered an amount on Item dd) and an increase in payroll is only basis for refund; and

6. a schedule and copies of receipts from state sales and use tax paid to a seller, if applicable.

Step 6:

I declare the information in this document is true and correct to the best of my knowledge and belief. I certify that I am in compliance

Sign and date

with each term of the abatement agreement(s) entered into with the municipality or county and have provided the abatement agreement(s)

the refund

to the Comptroller as required by law.

application.

__________________________________________________________

ff

Name:

___________________________________________________________

gg

Title:

________________________________________________________

hh

Signature:

/

-

ii

Phone (area code and number) :

/

-

Fax Number:

jj

1

Check this box if this form is being completed by an agent of the taxpayer.

(Attach Power of Attorney or other written authorization.)

Mail to:

Comptroller of Public Accounts

Property Tax Division

111 E. 17th Street

Austin, Texas 78774-0100

IMPORTANT NOTE: You must file a complete refund request with the Comptroller by July 31 of the year following the tax year subject to the

claim. Incomplete or late claims will not be processed. Call Property Tax Division at 1-800-252-9121 or 512/305-9999 for assistance.

1

1 2

2 3

3