Form 50-118 - Application For Youth Development Organization Property Tax Exemption Page 3

ADVERTISEMENT

50-118 (Rev. 8-03/9) - Page 3

[11.19-A]

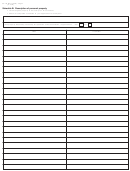

Schedule A: Description of real property

• Complete one Schedule A form for EACH parcel qualified for exemption.

• Attach all completed schedules to your application for exemption.

Name of owner

Legal description of property

Appraisal district account number (Optional):

Describe the primary use of this property.

Yes

No

Is the improvement currently under active construction or physical preparation? ..............................................................

If under construction, when will construction be completed? (date) _______________________**

If under physical preparation, check which activity the organization has done.

(Check all that apply.)

Architectural work

Land clearing activities

Engineering work

Site improvement work

Soil testing

Environmental or land use study

Is the incomplete improvement designed and intended to be used exclusively by the qualified youth development

Yes

No

associations when completed? ............................................................................................................................................

Yes

No

Does any portion of this property produce income? ............................................................................................................

If “Yes,” attach a statement describing use of the revenue.

Is the land on which the incomplete improvement is located reasonably necessary for the use of the improvement by

Yes

No

qualified youth development associations? .........................................................................................................................

List all other individuals and organizations that used this property in the past year, and give the requested information for each.

NAME

DATES USED

ACTIVITY

RENT PAID, IF ANY

Continue on additional sheets as needed.

**An incomplete improvement exempted for the three years preceding the 2003 tax year is entitled to exemption for the 2003 tax year regardless of whether

the property owner applies for the exemption for the 2003 tax year if the property otherwise qualifies. The chief appraiser may require the property owner

to file an application to confirm the owner’s qualification for exemption for the 2003 tax year. An exemption for an incomplete improvement is for five years.

Effective January 1, 2006, the exemption will revert back to three years.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4