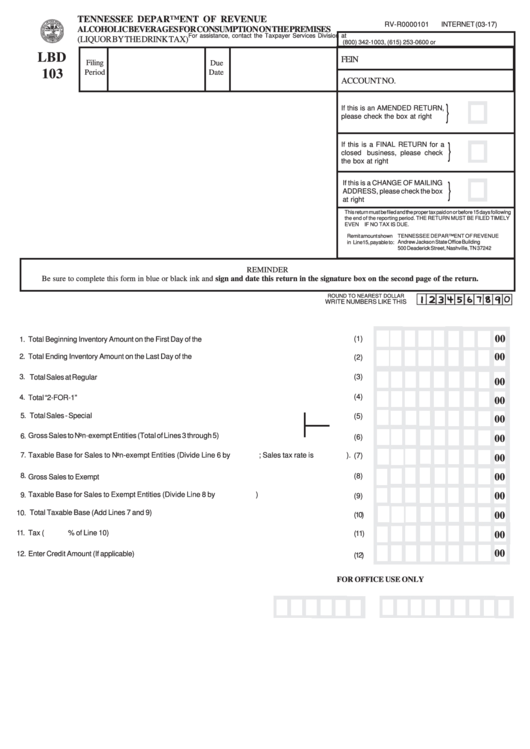

Form Lbd 103 - Alcoholic Beverages For Consumption On The Premises

ADVERTISEMENT

TENNESSEE DEPARTMENT OF REVENUE

RV-R0000101

INTERNET (03-17)

ALCOHOLIC BEVERAGES FOR CONSUMPTION ON THE PREMISES

For assistance, contact the Taxpayer Services Division at

(LIQUOR BY THE DRINK TAX)

(800) 342-1003, (615) 253-0600 or

LBD

FEIN

Filing

Due

103

Period

Date

ACCOUNT NO.

}

If this is an AMENDED RETURN,

please check the box at right

If this is a FINAL RETURN for a

}

closed

business, please check

the box at right

If this is a CHANGE OF MAILING

}

ADDRESS, please check the box

at right

This return must be filed and the proper tax paid on or before 15 days following

the end of the reporting period. THE RETURN MUST BE FILED TIMELY

EVEN IF NO TAX IS DUE.

Remit amount shown

TENNESSEE DEPARTMENT OF REVENUE

in Line15, payable to:

Andrew Jackson State Office Building

500 Deaderick Street, Nashville, TN 37242

REMINDER

Be sure to complete this form in blue or black ink and sign and date this return in the signature box on the second page of the return.

ROUND TO NEAREST DOLLAR

WRITE NUMBERS LIKE THIS

00

(1)

1.

Total Beginning Inventory Amount on the First Day of the Month..............................................................

00

2.

Total Ending Inventory Amount on the Last Day of the Month...................................................................

(2)

3.

(3)

Total Sales at Regular Prices....................................................................................................................

00

(4)

4.

Total “2-FOR-1” Sales...............................................................................................................................

00

Total Sales - Special Prices.............................................................................................

5.

(5)

00

Gross Sales to Non-exempt Entities (Total of Lines 3 through 5)....................................

6.

(6)

00

7.

Taxable Base for Sales to Non-exempt Entities (Divide Line 6 by

; Sales tax rate is

).

(7)

00

8.

(8)

00

Gross Sales to Exempt Entities.................................................................................................................

Taxable Base for Sales to Exempt Entities (Divide Line 8 by

)...............................................

9.

00

(9)

Total Taxable Base (Add Lines 7 and 9)..................................................................................................

10.

(10)

00

11.

Tax (

% of Line 10)........................................................................................................................

(11)

00

00

12.

Enter Credit Amount (If applicable)............................................................................................................

(12)

FOR OFFICE USE ONLY

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2