Form Lbd 103 - Alcoholic Beverages For Consumption On The Premises Page 2

ADVERTISEMENT

INTERNET (03-17)

00

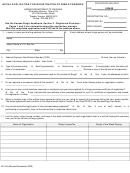

13.

Penalty (If filed late, see instructions)...................................................................................................

(13)

00

14.

Interest (If filed late, see instructions; current interest rate per annum is ______%)..........................

(14)

00

15.

Total Amount Due (Add Lines 11, 13, and 14; subtract Line 12 (credit) if applicable.

...........................

(15)

If your account number is not preprinted on the front of the return,

Under penalties of perjury, I declare that I have examined this report, and to the best of my knowledge and

enter your social security number (SSN) and/or federal employer

belief, it is true, correct, and complete.

identification number (FEIN) in the spaces below:

Check appropriate box

Taxpayer's Signature

Date

and fill in number below:

FEIN or SSN

Signature of Preparer other than Taxpayer

Date

Phone Number

Tax Preparer's Address

INSTRUCTIONS

GENERAL:

Since you have been licensed to sell alcoholic beverages for consumption on the premises, you are required to file monthly returns and pay the

applicable 15% tax. You are to report gross sales of alcoholic beverages, including all taxes. Sales of beer with an alcohol content less than

8%, food, and other items are NOT to be included in this report.

DUE DATE: The return along with the appropriate tax payment are due to be filed on or before the 15th day following the end of your accounting period. In addition

to penalty and interest being assessed, the late filing of a return or the underpayment of the tax must be reported to the Alcoholic Beverage

Commission by the Department of Revenue. Returns delinquent or underpaid three times during one license period may subject your license to

suspension or revocation.

TAXPAYER/TAX PREPARER'S SIGNATURE: You must sign and date your return. Paid preparers (accountants, attorneys, etc.) must also sign the return.

FILING:

Make your check payable to the Tennessee Department of Revenue for the amount shown on Line 15 of the return and mail with the return to:

Tennessee Department of Revenue, Andrew Jackson State Office Building, 500 Deaderick Street, Nashville, TN 37242. NOTE: The payment of

the tax by Electronic Funds Transfer (EFT) does not relieve you of filing a timely tax return.

AMENDED RETURNS: If this return is an "Amended Return," please indicate "Period Ending" on the front and check the appropriate box on the front of the form.

COMPUTATION OF TAX:

Line 1:

Enter the total inventory amout at the beginning of the reporting period in dollar amount.

Line 2:

Enter the total inventory amount at the end of the reporting period in dollar amount.

Line 3:

Enter the total sales made at regular prices during the reporting period. These are sales made to entities subject to sales tax.

Line 4:

Enter the total “2-for-1” sales made during the reporting period.

Line 5:

Enter the total of all other sales made at special prices during the reporting period. This includes sales at all prices other than regular prices or

2-for-1 sales.

Line 6:

Total the sales made during the reporting period to entities not exempt from sales tax by adding the amounts on Lines 3, 4, and 5.

Line 7:

The tax base factor for nonexempt sales is 1.15 plus your state and local sales tax rate. Divide Line 6 by this factor to determine Taxable Base

for Sales to Nonexempt Entities.

Line 8:

Enter gross sales made to entities exempt from sales tax during the reporting period. .

Line 9:

The tax base factor for sales to exempt entities is 1.15. Divide Line 8 by this factor to determine Taxable Base for Sales to Exempt Entities.

Line 10: Add Lines 7 and 9 to compute the total taxable base.

Line 11: Multiply Line 10 by 15% to determine the total amout of liquor-by-the-drink tax due.

Line 12: Enter the amount of any outstanding credit amount of liquor-by-the-drink tax previously notified by the Department.

Line 13: If filed late, penalty is computed at 5% of the tax (Line 11 minus the credit on Line 12) for each 30-day period or any fractional part of a 30-day

period that the return is delinquent. Total penalty is not to exceed 25% of the tax due; the minimum penalty is $15.00 regardless of the amount

of tax due or whether there is any tax due.

Line 14: If filed late, interest is computed at the current rate on the tax (Line 11 minus the credit on Line 12) from the due date to the date paid.

(Formula: Tax multiplied by current interest rate multiplied by the number of days late divided by 365.)

Line 15: Add Lines 11, 13, and 14; if credit balance entered on Line 12, subtract from total of Lines 11, 13, and 14 to determine net amount due.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2