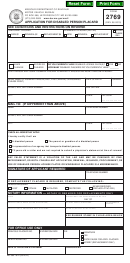

Pbctc Form 49 - Application For Business Tax Exemption For Disabled Persons, Widows With Minor Dependents Or Persons 65 Years Of Age Or Older - Palm Beach County Tax Collector Page 2

ADVERTISEMENT

PHYSICIAN’S CERTIFICATE

STATE OF FLORIDA

COUNTY OF ___________________________

I, _______________________________, hereby certify that I am a

licensed practicing physician, located at _______________________________,

Florida, and I am personally acquainted with _____________________________

who is the applicant for exemption from payment of business tax under the

provisions of Section 205.162, Florida Statutes, and that I have this day

thoroughly examined the said applicant and found him/her to be physically

disabled and unable to perform manual labor as a means of livelihood as stated

in the application of which this certificate is a part, the nature and extent of the

disability being as follows:

__________________________

Signature of Physician

FLORIDA STATUTE

205.162 Exemption allowed certain disabled persons, the aged, and

widows with minor dependents.

(1) All disabled persons physically incapable of manual labor, widows with

minor dependents, and persons 65 years of age or older, with not more than one

employee or helper, and who use their own capital only, not in excess of

$1,000.00, shall be allowed to engage in any business or occupation in counties

in which they live without being required to pay for a business tax receipt. The

exemption provided by this section shall be allowed only upon the certificate of

the county physician, or other reputable physician, that the applicant claiming the

exemption is disabled, the nature and extent of the disability being specified

therein, and in the case the exemption is claimed by a widow with minor

dependents, or a person over 65 years of age , proof of the right to the

exemption shall be made. Any person entitled to the exemption provided by this

section shall upon application and furnishing of the necessary proof of aforesaid,

be issued a receipt which shall have plainly stamped or written across the face

thereof the fact that it is based under this section, and the reason for the

exemption shall be written thereon.

(2) In no event under this or any other law shall any person, veteran or

otherwise, be allowed any exemption whatsoever from the payment of any

amount required by law for the issuance of a receipt to sell intoxicating liquors or

malt and vinous beverages.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2