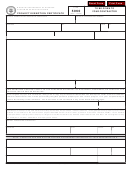

Form 488 (Rtc) - Transfer Certificate Page 3

ADVERTISEMENT

Form 488 (RTC) Revised 5-04

GEO

-

-

-

-

-

REALTY TRANSFER CERTIFICATE

CODE:

-

-

-

-

-

-

-

-

-

-

CONFIDENTIAL

-

-

-

-

-

Montana law requires this form and may impose up to a $500 penalty for

ASSESSMENT CODE:

failure to file a Realty Transfer Certificate (15-7-304, 305 and 310, MCA).

The Department of Revenue cannot change the name on ownership records used for the

PART 1 - Date of Sale/Death of

assessment and taxation of real property unless this form is fully and accurately com-

Joint Tenant

pleted and signed. Present the completed Realty Transfer Certificate to the Clerk &

Recorder when recording an instrument or deed evidencing a transfer of real estate.

Month/Day/Year

PART 2 - Parties - Names must be entered exactly as they appear on the transfer of ownership or

original document creating the joint tenancy

Seller / Deceased Joint Tenant - Enter grantor's / deceased joint tenant's complete name and mailing address, including city, state and ZIP.

Social Security # or Federal ID #

Daytime Phone #

Buyer / Surviving Joint Tenant - Enter grantee's / surviving joint tenant's complete name and assessment notice mailing address, including

city, state and ZIP.

Social Security # or Federal ID #

Daytime Phone #

PART 3 - Description of Property - If description is too lengthy, please attach a separate page

Legal Description:

Attachment

Add/Sub

Block

Lot

County

City/Town

Section

Township

Range

PART 4 - Grantor or Deceased Joint Tenant / Grantee or Surviving Joint Tenant is exempt from reporting sale

information because: (Check Only One)

Property is agricultural land which will remain in that use.

Transfer is a gift.

Property is timberland which will remain in the use of

Transfer is between husband and wife or parent and child

producing timber

with nominal actual consideration

Purchaser is U.S., State, or Other governmental agency

Purchaser and seller are identical parties.

Transfer is to correct, modify or supplement a previously recorded

Transfer is pursuant to deliquent taxes, sheriff sales, bankruptcy

instrument. NO ADDITIONAL CONSIDERATION IS MADE

or foreclosure.

Transfer is pursuant to a court decree.

Transfer is made in contemplation of death without

Transfer is pursuant to a merger, consolidation or reorganization

actual consideration.

of a business as defined by section 368, IRC.

Transfer is from a subsidiary to a parent corporation without

Transfer is pursuant to a decedent's estate.

actual consideration

Other (Specify Type)__________________________________

PART 5 - Sale Information - Must be completed unless exempt in Part 4 - Preparer may attach copy of buy/sell agreement

Yes

No

Actual Sale Price: $ _________________________

Was an SID payoff included in the sale price?

Financing:

Cash

FHA

VA

Contract

Other

Did the buyer assume an SID?

Yes

No

Terms:

New Loan

or

Assumption of Existing Loan Amount of SID Paid or assumed: $_________________

Value of personal property included in sale: $______________

Was a mobile home included in the sale?

Yes

No

PART 6 - Water Right Disclosure -- REQUIRED BY LAW -- (Check Only One)

For questions concerning this disclosure of Water Rights, you may want to seek legal advice.

Grantor / deceased joint tenant property has water rights and all water rights transfer.

Grantor / deceased joint tenant property has water rights but seller has reserved them so no water rights transfer.

Grantor / deceased joint tenant property has water rights but not all water rights transfer.

Grantor / deceased joint tenant property has no water rights of record with the Department of Natural Resources & Conservation.

(See important information on reverse side pink copy.)

I declare I have examined the above water right disclosure information and it is true and correct.

After closing, a copy of the signed disclosure will be provided to the buyer.

______________________________________________________________

Grantor (seller) signature

Property transaction is exempt from the disclosure because:

Property is served only by a public service water supply. (No signature required.)

Deed was in escrow prior to January 1, 1998. (No signature required.)

T

W

R

T

C

O UPDATE WATER RIGHT OWNERSHIP, COMPLETE THE

ATER

IGHT

RANSFER

ERTIFICATE ON THE PINK COPY OF THIS DOCUMENT.

WRTC

A $50.00 FINE CAN BE IMPOSED FOR FAILURE TO FILE A

, IF REQUIRED

PART 7 - Preparer Information - Please print or type - Preparer's signature is required

Name/Title_________________________________________________________________________________________

Mailing Address_____________________________________________________________________________________

____________________________________

Signature

Daytime Phone #______________________________

Clerk & Recorder Use Only

Type of Instrument:

Recording Information:

Warranty

Trust Deed

Quit Claim

Interest

Document #___________________________

Grant

Notice of Purchaser's Interest

Contract For Deed

Statement of Acknowledgment

Book ______________ Page __________

Bargain & Sale Deed

Termination of Joint Tenancy

Decree

Tax Deed

Date_________________________________

______________________________

Department of Revenue Copy

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5