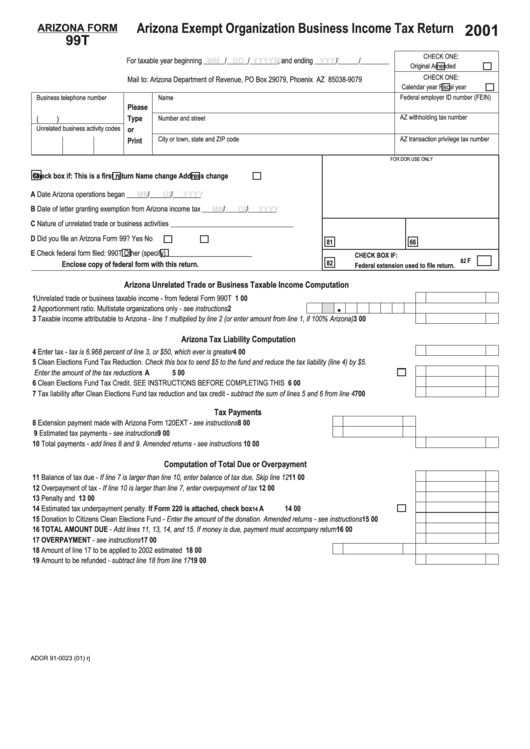

Arizona Form 99t - Arizona Exempt Organization Business Income Tax Return - 2001

ADVERTISEMENT

Arizona Exempt Organization Business Income Tax Return

2001

ARIZONA FORM

99T

CHECK ONE:

For taxable year beginning ______/______/________, and ending ______/______/________

MM

DD

YYYY

MM

DD

YYYY

Original

Amended

CHECK ONE:

Mail to: Arizona Department of Revenue, PO Box 29079, Phoenix AZ 85038-9079

Calendar year

Fiscal year

Federal employer ID number (FEIN)

Business telephone number

Name

Please

AZ withholding tax number

Type

(

)

Number and street

Unrelated business activity codes

or

AZ transaction privilege tax number

City or town, state and ZIP code

Print

FOR DOR USE ONLY

Check box if:

This is a rst return

Name change

Address change

68

A

Date Arizona operations began ______/______/________

MM

DD

YYYY

B

Date of letter granting exemption from Arizona income tax ______/______/________

MM

DD

YYYY

C

Nature of unrelated trade or business activities ___________________________________

D

Did you le an Arizona Form 99?

Yes

No

81

66

E

Check federal form led:

990T

Other (specify) ________________________

CHECK BOX IF:

F

82

82

Enclose copy of federal form with this return.

Federal extension used to le return.

Arizona Unrelated Trade or Business Taxable Income Computation

1 Unrelated trade or business taxable income - from federal Form 990T .......................................................................................

1

00

2 Apportionment ratio. Multistate organizations only - see instructions...............................

2

•

3 Taxable income attributable to Arizona - line 1 multiplied by line 2 (or enter amount from line 1, if 100% Arizona) .....................

3

00

Arizona Tax Liability Computation

4 Enter tax - tax is 6.968 percent of line 3, or $50, which ever is greater........................................................................................

4

00

5 Clean Elections Fund Tax Reduction. Check this box to send $5 to the fund and reduce the tax liability (line 4) by $5.

Enter the amount of the tax reduction................................................................................................................................

A

5

00

5

6 Clean Elections Fund Tax Credit. SEE INSTRUCTIONS BEFORE COMPLETING THIS LINE...................................................

6

00

7 Tax liability after Clean Elections Fund tax reduction and tax credit - subtract the sum of lines 5 and 6 from line 4....................

7

00

Tax Payments

8 Extension payment made with Arizona Form 120EXT - see instructions ........................................

8

00

9 Estimated tax payments - see instructions ......................................................................................

9

00

10 Total payments - add lines 8 and 9. Amended returns - see instructions .....................................................................................

10

00

Computation of Total Due or Overpayment

11 Balance of tax due - If line 7 is larger than line 10, enter balance of tax due. Skip line 12...........................................................

11

00

12 Overpayment of tax - If line 10 is larger than line 7, enter overpayment of tax ............................................................................

12

00

13 Penalty and interest ......................................................................................................................................................................

13

00

14 Estimated tax underpayment penalty. If Form 220 is attached, check box ...................................................................

A

14

00

14

15 Donation to Citizens Clean Elections Fund - Enter the amount of the donation. Amended returns - see instructions .................

15

00

16 TOTAL AMOUNT DUE - Add lines 11, 13, 14, and 15. If money is due, payment must accompany return ................................

16

00

17 OVERPAYMENT - see instructions..............................................................................................................................................

17

00

18 Amount of line 17 to be applied to 2002 estimated tax....................................................................

18

00

19 Amount to be refunded - subtract line 18 from line 17..................................................................................................................

19

00

ADOR 91-0023 (01) rj

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2