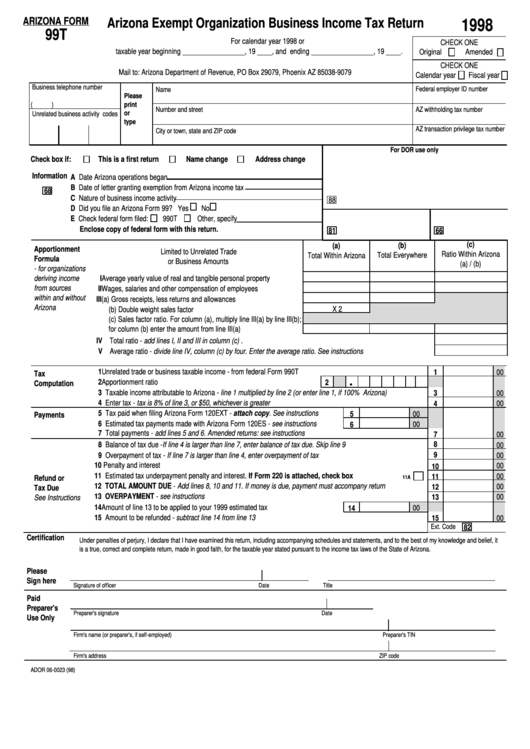

ARIZONA FORM

Arizona Exempt Organization Business Income Tax Return

1998

99T

For calendar year 1998 or

CHECK ONE

taxable year beginning _________________, 19 ____, and ending _________________, 19 ____.

Original

Amended

CHECK ONE

Mail to: Arizona Department of Revenue, PO Box 29079, Phoenix AZ 85038-9079

Calendar year

Fiscal year

Business telephone number

Federal employer ID number

Name

Please

(

)

print

Number and street

AZ withholding tax number

or

Unrelated business activity codes

type

AZ transaction privilege tax number

City or town, state and ZIP code

For DOR use only

Check box if:

This is a first return

Name change

Address change

Information

A Date Arizona operations began

B Date of letter granting exemption from Arizona income tax

68

C Nature of business income activity

88

D Did you file an Arizona Form 99? Yes

No

E Check federal form filed:

990T

Other, specify

Enclose copy of federal form with this return.

81

66

(c)

(a)

(b)

Apportionment

Limited to Unrelated Trade

Ratio Within Arizona

Total Within Arizona

Total Everywhere

Formula

or Business Amounts

(a) / (b)

- for organizations

deriving income

I Average yearly value of real and tangible personal property ...........

from sources

II Wages, salaries and other compensation of employees ..................

within and without

III (a) Gross receipts, less returns and allowances ..............................

Arizona

X 2

(b) Double weight sales factor ..........................................................

(c) Sales factor ratio. For column (a), multiply line III(a) by line III(b);

for column (b) enter the amount from line III(a) ................................

IV Total ratio - add lines I, II and III in column (c) ............................................................................................................

V Average ratio - divide line IV, column (c) by four. Enter the average ratio. See instructions ......................................

1 Unrelated trade or business taxable income - from federal Form 990T ....................................................................

1

00

Tax

2 Apportionment ratio .....................................................................................

2

Computation

3 Taxable income attributable to Arizona - line 1 multiplied by line 2 (or enter line 1, if 100% Arizona) ....................

3

00

4 Enter tax - tax is 8% of line 3, or $50, whichever is greater .....................................................................................

4

00

5 Tax paid when filing Arizona Form 120EXT - attach copy. See instructions ..........

5

00

Payments

6 Estimated tax payments made with Arizona Form 120ES - see instructions ...........

6

00

7 Total payments - add lines 5 and 6. Amended returns: see instructions ..................................................................

7

00

8

8 Balance of tax due - If line 4 is larger than line 7, enter balance of tax due. Skip line 9 ..........................................

00

9

9 Overpayment of tax - If line 7 is larger than line 4, enter overpayment of tax ..........................................................

00

10 Penalty and interest ..................................................................................................................................................

00

10

11 Estimated tax underpayment penalty and interest. If Form 220 is attached, check box ...........................

00

11

Refund or

11A

12 TOTAL AMOUNT DUE - Add lines 8, 10 and 11. If money is due, payment must accompany return ....................

00

12

Tax Due

13 OVERPAYMENT - see instructions ..........................................................................................................................

13

00

See Instructions

14 Amount of line 13 to be applied to your 1999 estimated tax .....................................

14

00

15 Amount to be refunded - subtract line 14 from line 13 ..............................................................................................

15

00

Ext. Code

82

Certification

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it

is a true, correct and complete return, made in good faith, for the taxable year stated pursuant to the income tax laws of the State of Arizona.

Please

Sign here

Signature of officer

Date

Title

Paid

Preparer's

Preparer's signature

Date

Use Only

Firm's name (or preparer's, if self-employed)

Preparer's TIN

Firm's address

ZIP code

ADOR 06-0023 (98)

1

1