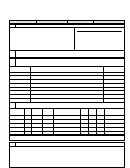

WORKSHEET 1 -

QUALIFYING WAGES, TIPS, SALARIES, OTHER EMPLOYEE COMPENSATION

(Wages reported from W-2’s are typically Box 5, refer to instructions regarding “Qualifying Wages” for further explanation)

NAME OF EMPLOYER

CITY WHERE

INCOME FROM

*2106 EXPENSE

TROY TAX

*OTHER CITY TAX

EMPLOYED

EACH W-2

(AFTER 2% AGI)

WITHHELD

WITHHELD

TOTALS:

To Page 1, Line 1

To Page 1, Line 1A

To Page 1, Line 5A

To Page 1, Line 5B

* Income reduced by 2106 expense and earned in another city must also reduce the tax withheld / credit for tax withheld for another city accordingly.

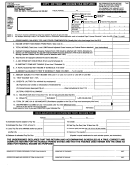

WORKSHEET 2 - SCHEDULE C, SCHEDULE E, SCHEDULE F

Attach copies of all Federal Schedules. If tax paid to another municipality, other city returns must be attached. For further instruction,

please refer to

Troy City Tax Ordinance.

SCHEDULE C

SOLE PROPRIETORSHIP

Business name:_______________________________________ Business address:____________________________________________

Nature of business:____________________________________ Date started:__________________

Date ended:__________________

A. Net profit or loss from Schedule C (must be attached). If multiple, all must be attached.

$________________________

(Complete this information separately for each Schedule C by attaching separate form)

B. Percentage amount allowable or reportable to Troy. If sole proprietor or business is located in Troy,

________________________

100% reportable. Provide copies of other city tax returns filed to allow credit for tax paid.

NET PROFIT / LOSS SCHEDULE C

(Provide documentation to support percentage used / allocation).

C. Amount subject to tax (multiply A times B).

SCHEDULE E

RENTAL PROPERTY

RENTAL NET PROFIT / LOSS SCHEDULE E

Attach Schedule E’s, and provide name(s) of legal owners of each property.

(This can be documented on the Schedule E copy remitted)

SCHEDULE E

OTHER REPORTABLE INCOME / LOSS (Partnerships, estates, trusts, etc)

OTHER SCHEDULE E PROFIT / LOSS

Attach Schedule E’s, and provide name(s) of participants in each activity. Be

sure to identify physical location. Entities located in Troy must file with Troy

as such.

NET PROFIT / LOSS SCHEDULE F

SCHEDULE F

FARM INCOME

Attach Schedule F.

WORKSHEET 2 TOTAL**

$________________________

**Losses from federal schedules and other sources reported for federal income tax purposes cannot be used to offset qualifying wages, commissions, other compensation and

other taxable income earned or received by residents or nonresidents of the Municipality. If an individual is engaged in two or more taxable business activities to be included

in the same return, the net loss of one unincorporated business activity may be used to offset the profits of another (except any portion of a loss or profit separately reportable

for municipal tax purposes to another taxing entity) for purposes of arriving at overall net profits or net operating loss.

WORKSHEET 3 -

OTHER INCOME (Attach appropriate forms /schedules/statements).

Income from lottery, gambling, etc. to be included on this worksheet.

RECEIVED FROM NAME / I.D. NUMBER

FOR (DESCRIPTION AND/OR LOCATION)

AMOUNT

(APPLICABLE LOSSES WITHOUT EXACT LOCATIONS / DOCUMENTATION WILL BE DISALLOWED)

For gambling winnings, report the amount after loss deduction (cannot be less than zero).

Attach page 1 and 2 of 1040 and Schedule A.

________________________________

____________________________________________________________

_____________

________________________________

____________________________________________________________

_____________

WORKSHEET 3 TOTAL

$ _______________________

CALCULATIONS FOR FRONT OF RETURN

A. Worksheet 2 total:

_________________

(CANNOT BE LESS THAN ZERO. IF LESS THAN ZERO, LEAVE BLANK.)

B.

Worksheet 3 total:

_________________

TOTAL OF A AND B ABOVE:

_________________

PLACE THIS NUMBER ON LINE 2, PAGE 1 of TROY TAX RETURN.

1

1 2

2 3

3 4

4