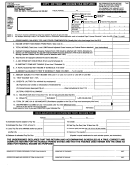

INSTRUCTIONS FOR COMPLETING YOUR

CITY OF TROY INCOME TAX RETURN

Print your name, address and social security number plainly or make needed corrections if already

HEADING

printed. If you have moved, indicate date of move, present address and old address. Indicate whether

you are filing a single return, married filing joint, or married filing separately. Please provide your

home phone number so that we may contact you with any questions regarding your return. Sign up for

future updates by completing your e-mail address.

SECTION A

Using the worksheets on the reverse, list each W-2 and 1099-MISC separately. Attach a separate sheet

if necessary. (If 1099-MISC is included in gross receipts on Schedule C, do not list here. Schedule

income is reported on Line 2). For each W-2, enter the employer’s name, the city where work was

actually performed, the amount of Troy tax withheld, credit for other city tax withheld

(see

instructions for line 5B below.) Attach all W-2’s and 1099-misc forms. (Photocopies are acceptable).

LINE 1

Add the total W-2 wages from the reverse worksheet and enter on line 1. Your

reportable and taxable income from W-2’s is typically from Box 5, however exceptions

apply. Please refer to the information included regarding “Qualifying Wages.” This

will further explain what income from your W-2’s is taxable and reportable.

LINE 1A

Enter the amount of allowable 2106 expense. The allowable 2106 expense is the

amount actually deducted from Schedule A, after the 2% AGI. Miscellaneous expenses

only deducted on Schedule A are not permitted. For more information, please go to

ATTACH COPY OF 2106, SCHEDULE A, and PAGES 1 and 2 of

your FEDERAL TAX RETURN.

LINE 2

Enter the total of all other income and adjustments, from reverse of tax form

(worksheet). All schedules must be attached. (See Worksheets on reverse)

LINE 3

Add lines 1, 1A and 2. This is the amount of income subject to tax.

LINE 4

Multiply the amount of income on line 3 by 1.75% (.0175)

LINE 5

Credits.

5A

Enter the total Troy tax withheld. Be sure to include copies of your W-2’s

which actually show this tax withheld. (If your W-2 shows the name of locality

for tax withheld as “5509”, “SD5509” or some other variation, this is Troy

School District Income Tax withheld. School District Income Tax withheld is

not used on your City of Troy Income Tax Return.)

5B

Enter a credit for the tax you paid to other cities on the income you have

reported on this return. (Be sure to include copies of W-2’s which actually

show this tax withheld. If you paid this tax directly, and it was not withheld, be

sure to include a receipted copy of your tax return filing.) DO NOT ENTER

THE ACTUAL AMOUNT OF TAX YOU PAID. You must calculate the credit

by using the following steps:

STEP 1

If all of your income was earned in a city with a tax rate equal to

or less than 1.75%, your credit is the amount of tax withheld

(provided the amount withheld is correct).

STEP 2

If your income was earned in a city with a tax rate that is greater

than 1.75%, determine what portion of your W-2 wages had tax

withheld at the greater rate. Then, multiply that part of your W-2

wages by 1.75% to find your credit. This step must be completed

for each W-2. Please note that for both steps 1 and 2, if income

has been pro-rated or reduced (due to 2106 deduction, partial year

residency, or for any other reason), credits must also be pro-rated

or reduced.

1

1 2

2 3

3 4

4