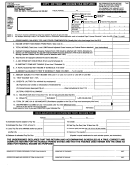

5C

Total of estimated tax payments that you have paid directly to the City of Troy

5D

Prior year tax overpayment that you have carried forward for use on this return.

(Do not include amounts refunded to you).

5 E

Add 5A through 5D. This is your total tax credit.

LINE 6

Subtract line 5E from line 4. If line 4 is greater than line 5E, you have a balance due.

($10 or more). Note: If the return shows a balance due of less than $10, and your overall

liability (total due out of pocket after amounts withheld excluding estimated tax

payments made) to be paid for this tax year exceeds $10, you owe the remaining amount

due. Failure to pay this amount will result in a bill being sent and possible penalty and

interest charge if not paid by the due date. Make sure to complete all lines before

signing and remitting return with payment.

LINE 7

If line 5E is greater than line 4, you have an overpayment of tax. ($10 or more).

Indicate whether you prefer to credit this to tax year 2017, or have this overpayment

refunded. Allow 90 days for processing of a refund. Note: If you had no Troy tax

withheld, or no estimated tax paid, or no prior year credits, and you show an

overpayment of tax, please re-check your calculations as there is no refund due.

LINE 8

Late payment and/or late filing will result in the assessment of penalty and interest

charges. Please contact our office for appropriate rates if applicable.

Balance due. Line 6 plus line 8. DO NOT STOP HERE. If you expect to owe more than

LINE 9

$200 next year, you must complete lines 10-14.

LINE 10

Total estimated tax due for 2017. (Income multiplied by tax rate of 1.75%).

SECTION B

LINE 11

Less credits for tax to be withheld by employers, and prior year credit carried forward

(from line 7)

LINE 12

Net tax due. Line 10 minus line 11.

LINE 13

First quarter estimated tax due (at least 22.5% of line 12.) By paying 22.5% each quarter,

you will have 90% of your liability paid prior to filing of your 2017 Individual Income Tax

Return. If you are unsure of what your 2017 liability will be, you can pay 100% of your

previous year liability (2016) by December 15, 2017. This is called “safe harbor”. Please

review the educational page for more information.

LINE 14

TOTAL DUE. Line 9 plus line 13. PAYMENT IN FULL IS DUE BY 4/18/17.

Please make checks payable to the City of Troy. Online credit card payments using

MasterCard, Visa and Discover Card can also be made. Visit the City website at

for more information.

Complete the return by signing, indicating your occupation, and dating the return. Copies of all W-2’s,

SECTION C

1099’s, Federal Schedules including page 1 of your federal tax return, and all other supporting docu-

mentation must be attached. Be sure to remit payment in full with the completed return.

1

1 2

2 3

3 4

4