Form Ar1050 - Partnership Income Tax Return - 2016

ADVERTISEMENT

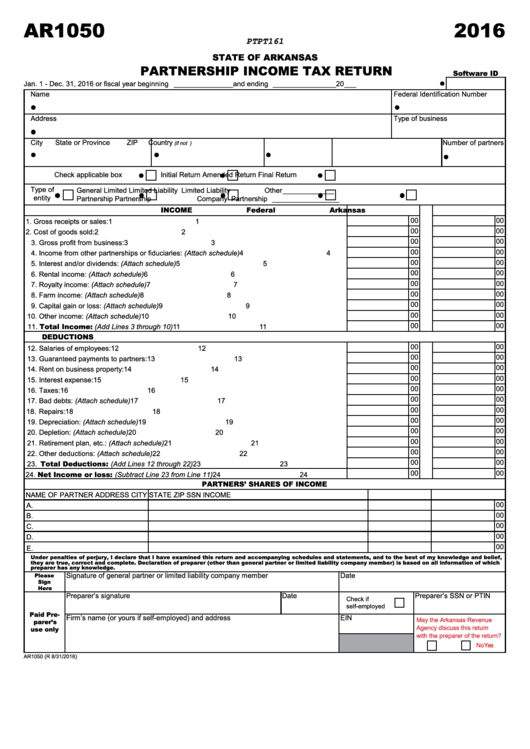

AR1050

2016

PTPT161

STATE OF ARKANSAS

PARTNERSHIP INCOME TAX RETURN

Software ID

Jan. 1 - Dec. 31, 2016 or fiscal year beginning _______________ and ending ________________ 20 ___

Name

Federal Identification Number

Address

Type of business

City

State or Province

ZIP

Country

Number of partners

(if not U.S.)

Check applicable box

Initial Return

Amended Return

Final Return

Type of

General

Limited

Limited Liability

Limited Liability

Other _____________

entity

Partnership

Partnership

Company

Partnership

_________________

INCOME

Federal

Arkansas

00

00

1. Gross receipts or sales: ................................................................................................................... 1

1

00

00

2. Cost of goods sold: .......................................................................................................................... 2

2

00

00

3. Gross profit from business: ............................................................................................................. 3

3

00

00

4. Income from other partnerships or fiduciaries: (Attach schedule) ................................................... 4

4

00

00

5. Interest and/or dividends: (Attach schedule) ................................................................................... 5

5

00

00

6. Rental income: (Attach schedule) ................................................................................................... 6

6

00

00

7. Royalty income: (Attach schedule) .................................................................................................. 7

7

00

00

8. Farm income: (Attach schedule) ..................................................................................................... 8

8

00

00

9. Capital gain or loss: (Attach schedule) ............................................................................................ 9

9

00

00

10. Other income: (Attach schedule) ................................................................................................... 10

10

00

00

11. Total Income: (Add Lines 3 through 10) ....................................................................................11

11

DEDUCTIONS

00

00

12. Salaries of employees: .................................................................................................................. 12

12

00

00

13. Guaranteed payments to partners: ................................................................................................ 13

13

00

00

14. Rent on business property: ........................................................................................................... 14

14

00

00

15. Interest expense: ........................................................................................................................... 15

15

00

00

16. Taxes: ............................................................................................................................................ 16

16

00

00

17. Bad debts: (Attach schedule) ........................................................................................................ 17

17

00

00

18. Repairs: ......................................................................................................................................... 18

18

00

00

19. Depreciation: (Attach schedule) .................................................................................................... 19

19

00

00

20. Depletion: (Attach schedule) ......................................................................................................... 20

20

00

00

21. Retirement plan, etc.: (Attach schedule) ....................................................................................... 21

21

00

00

22. Other deductions: (Attach schedule) ............................................................................................. 22

22

00

00

23. Total Deductions: (Add Lines 12 through 22) ......................................................................... 23

23

00

00

24. Net Income or loss: (Subtract Line 23 from Line 11).............................................................. 24

24

PARTNERS’ SHARES OF INCOME

NAME OF PARTNER

ADDRESS

CITY

STATE

ZIP

SSN

INCOME

00

A.

00

B.

00

C.

00

D.

00

E.

Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and belief,

they are true, correct and complete. Declaration of preparer (other than general partner or limited liability company member) is based on all information of which

preparer has any knowledge.

Signature of general partner or limited liability company member

Date

Please

Sign

Here

Preparer’s signature

Date

Preparer’s SSN or PTIN

Check if

self-employed

Paid Pre-

Firm’s name (or yours if self-employed) and address

EIN

May the Arkansas Revenue

parer’s

Agency discuss this return

use only

with the preparer of the return?

Yes

No

AR1050 (R 8/31/2016)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2