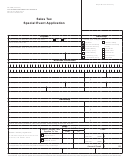

Sales Tax Remittance Return Form - State Of Washington Department Of Revenue - 2016 Page 2

ADVERTISEMENT

Instructions for Completing the Sales Tax Remittance Return

You must do one of the following steps by January 31, 2017:

If you did not have business activity in 2016, you must still file your return by using

4

one of the following options:

E-file: Use our free E-File service at dor.wa.gov.

Phone: You can use our automated system at any time by calling 1-800-647-7706.

At the greeting, enter 1 at each prompt, your 9 digit tax registration number,

and then follow the instructions given.

Mail:

Check the “no business activity” box at the top of your return, sign and date it,

and mail to the address listed on the front of this tax return.

If you had business activity in 2016:

4

1. Determine if your gross income is less than $28,000.

•

If you know the amount of retail sales tax collected, enter that amount in

the Sales Tax Collected box, line 1.

•

If you do not know the amount of retail sales tax collected, multiply your

taxable retail sales by the sales tax rate. To get a list of sales tax rates or to

use the Tax Rate Lookup Tool, visit our website at dor.wa.gov and click on

Find Taxes and Rates.

If it is equal to or greater than $28,000, you can not use this form. To obtain the

correct form or to file electronically, please go to our website at dor.wa.gov and

click on Get a Form or Publication.

2. If you are filing your return after the due date, see the penalty rates located on

the front of this return and multiply the penalty rate you owe by the Sales Tax

Collected. Write this penalty amount in the Penalty box, line 2.

If you are requesting a penalty waiver, please check the box on the front of this

return and attach your written request to this return. For more information

about penalty waiver criteria, please call 1-800-334-8969 and enter code 429.

3. Add lines 1 - 2 and enter the amount in the Total Amount Owed box, line 3.

4. Make check or money order payable to the Washington State Department of

Revenue.

5. Please write your tax registration number on your check.

Keep a copy of your return for your files and mail the original form with your payment.

4

Electronic Filing

The simplest way to file your return is to use our free E-file service at dor.wa.gov. If you don’t have

a Logon ID or Password, click on “Register” and follow the instructions using the Tax Registration

No. and Pre-Assigned Access Code (PAC) that is printed on the front of this return.

For tax assistance or to request this document in an alternate format, please call 1-800-647-7706. Teletype (TTY) users

may use the Washington Relay Service by calling 711.

Internet/Fax

(11-10-16)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2