Nebraska Department of Banking and Finance

Commerce Court, 1230 “O” Street, Suite 400

PO Box 95006

Bureau of Securities

Lincoln, NE 68509-5006

(402) 471-3445

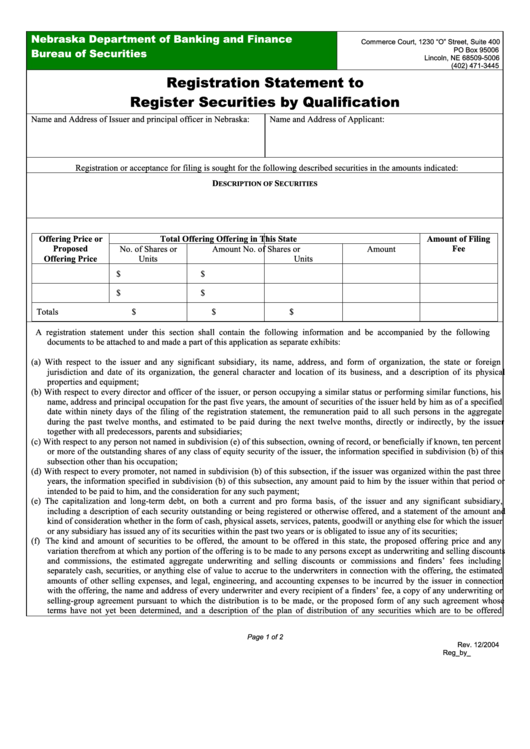

Registration Statement to

Register Securities by Qualification

Name and Address of Issuer and principal officer in Nebraska:

Name and Address of Applicant:

Registration or acceptance for filing is sought for the following described securities in the amounts indicated:

D

S

ESCRIPTION OF

ECURITIES

Offering Price or

Total Offering

Offering in This State

Amount of Filing

Proposed

Fee

No. of Shares or

Amount

No. of Shares or

Amount

Offering Price

Units

Units

$

$

$

$

Totals

$

$

$

A registration statement under this section shall contain the following information and be accompanied by the following

documents to be attached to and made a part of this application as separate exhibits:

(a) With respect to the issuer and any significant subsidiary, its name, address, and form of organization, the state or foreign

jurisdiction and date of its organization, the general character and location of its business, and a description of its physical

properties and equipment;

(b) With respect to every director and officer of the issuer, or person occupying a similar status or performing similar functions, his

name, address and principal occupation for the past five years, the amount of securities of the issuer held by him as of a specified

date within ninety days of the filing of the registration statement, the remuneration paid to all such persons in the aggregate

during the past twelve months, and estimated to be paid during the next twelve months, directly or indirectly, by the issuer

together with all predecessors, parents and subsidiaries;

(c) With respect to any person not named in subdivision (e) of this subsection, owning of record, or beneficially if known, ten percent

or more of the outstanding shares of any class of equity security of the issuer, the information specified in subdivision (b) of this

subsection other than his occupation;

(d) With respect to every promoter, not named in subdivision (b) of this subsection, if the issuer was organized within the past three

years, the information specified in subdivision (b) of this subsection, any amount paid to him by the issuer within that period or

intended to be paid to him, and the consideration for any such payment;

(e) The capitalization and long-term debt, on both a current and pro forma basis, of the issuer and any significant subsidiary,

including a description of each security outstanding or being registered or otherwise offered, and a statement of the amount and

kind of consideration whether in the form of cash, physical assets, services, patents, goodwill or anything else for which the issuer

or any subsidiary has issued any of its securities within the past two years or is obligated to issue any of its securities;

(f) The kind and amount of securities to be offered, the amount to be offered in this state, the proposed offering price and any

variation therefrom at which any portion of the offering is to be made to any persons except as underwriting and selling discounts

and commissions, the estimated aggregate underwriting and selling discounts or commissions and finders’ fees including

separately cash, securities, or anything else of value to accrue to the underwriters in connection with the offering, the estimated

amounts of other selling expenses, and legal, engineering, and accounting expenses to be incurred by the issuer in connection

with the offering, the name and address of every underwriter and every recipient of a finders’ fee, a copy of any underwriting or

selling-group agreement pursuant to which the distribution is to be made, or the proposed form of any such agreement whose

terms have not yet been determined, and a description of the plan of distribution of any securities which are to be offered

Page 1 of 2

Rev. 12/2004

Reg_by_Qual.doc

1

1 2

2