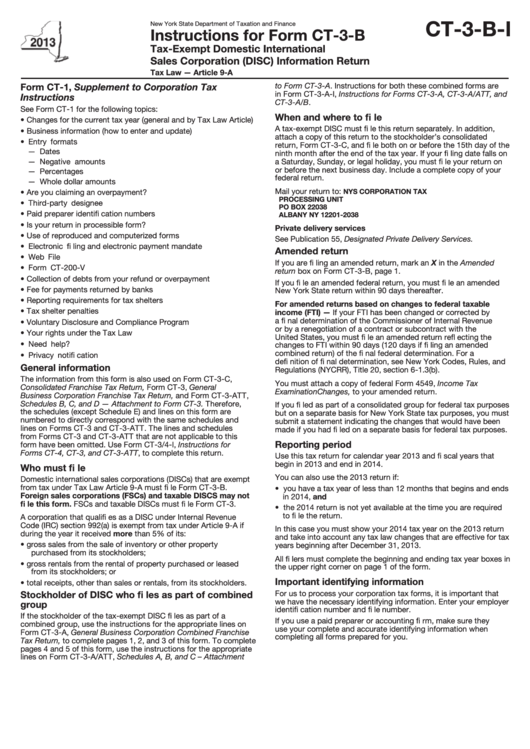

Form Ct-3-B-I - Instructions For Form Ct-3-B - New York State Department Of Taxation And Finance - 2013

ADVERTISEMENT

CT-3-B-I

New York State Department of Taxation and Finance

Instructions for Form CT-3-B

Tax-Exempt Domestic International

Sales Corporation (DISC) Information Return

Tax Law — Article 9-A

to Form CT-3-A. Instructions for both these combined forms are

Form CT-1, Supplement to Corporation Tax

in Form CT-3-A-I, Instructions for Forms CT-3-A, CT-3-A/ATT, and

Instructions

CT-3-A/B.

See Form CT-1 for the following topics:

When and where to fi le

• Changes for the current tax year (general and by Tax Law Article)

A tax-exempt DISC must fi le this return separately. In addition,

• Business information (how to enter and update)

attach a copy of this return to the stockholder’s consolidated

• Entry formats

return, Form CT-3-C, and fi le both on or before the 15th day of the

— Dates

ninth month after the end of the tax year. If your fi ling date falls on

— Negative amounts

a Saturday, Sunday, or legal holiday, you must fi le your return on

or before the next business day. Include a complete copy of your

— Percentages

federal return.

— Whole dollar amounts

Mail your return to:

• Are you claiming an overpayment?

NYS CORPORATION TAX

PROCESSING UNIT

• Third-party designee

PO BOX 22038

• Paid preparer identifi cation numbers

ALBANY NY 12201-2038

• Is your return in processible form?

Private delivery services

• Use of reproduced and computerized forms

See Publication 55, Designated Private Delivery Services.

• Electronic fi ling and electronic payment mandate

Amended return

• Web File

If you are fi ling an amended return, mark an X in the Amended

• Form CT-200-V

return box on Form CT-3-B, page 1.

• Collection of debts from your refund or overpayment

If you fi le an amended federal return, you must fi le an amended

• Fee for payments returned by banks

New York State return within 90 days thereafter.

• Reporting requirements for tax shelters

For amended returns based on changes to federal taxable

• Tax shelter penalties

income (FTI) — If your FTI has been changed or corrected by

a fi nal determination of the Commissioner of Internal Revenue

• Voluntary Disclosure and Compliance Program

or by a renegotiation of a contract or subcontract with the

• Your rights under the Tax Law

United States, you must fi le an amended return refl ecting the

• Need help?

changes to FTI within 90 days (120 days if fi ling an amended

combined return) of the fi nal federal determination. For a

• Privacy notifi cation

defi nition of fi nal determination, see New York Codes, Rules, and

General information

Regulations (NYCRR), Title 20, section 6-1.3(b).

The information from this form is also used on Form CT-3-C,

You must attach a copy of federal Form 4549, Income Tax

Consolidated Franchise Tax Return, Form CT-3, General

Examination Changes, to your amended return.

Business Corporation Franchise Tax Return, and Form CT-3-ATT,

Schedules B, C, and D — Attachment to Form CT-3. Therefore,

If you fi led as part of a consolidated group for federal tax purposes

the schedules (except Schedule E) and lines on this form are

but on a separate basis for New York State tax purposes, you must

numbered to directly correspond with the same schedules and

submit a statement indicating the changes that would have been

lines on Forms CT-3 and CT-3-ATT. The lines and schedules

made if you had fi led on a separate basis for federal tax purposes.

from Forms CT-3 and CT-3-ATT that are not applicable to this

Reporting period

form have been omitted. Use Form CT-3/4-I, Instructions for

Forms CT-4, CT-3, and CT-3-ATT, to complete this return.

Use this tax return for calendar year 2013 and fi scal years that

begin in 2013 and end in 2014.

Who must fi le

You can also use the 2013 return if:

Domestic international sales corporations (DISCs) that are exempt

from tax under Tax Law Article 9-A must fi le Form CT-3-B.

• you have a tax year of less than 12 months that begins and ends

Foreign sales corporations (FSCs) and taxable DISCS may not

in 2014, and

fi le this form. FSCs and taxable DISCs must fi le Form CT-3.

• the 2014 return is not yet available at the time you are required

to fi le the return.

A corporation that qualifi es as a DISC under Internal Revenue

Code (IRC) section 992(a) is exempt from tax under Article 9-A if

In this case you must show your 2014 tax year on the 2013 return

during the year it received more than 5% of its:

and take into account any tax law changes that are effective for tax

• gross sales from the sale of inventory or other property

years beginning after December 31, 2013.

purchased from its stockholders;

All fi lers must complete the beginning and ending tax year boxes in

• gross rentals from the rental of property purchased or leased

the upper right corner on page 1 of the form.

from its stockholders; or

Important identifying information

• total receipts, other than sales or rentals, from its stockholders.

For us to process your corporation tax forms, it is important that

Stockholder of DISC who fi les as part of combined

we have the necessary identifying information. Enter your employer

group

identifi cation number and fi le number.

If the stockholder of the tax-exempt DISC fi les as part of a

If you use a paid preparer or accounting fi rm, make sure they

combined group, use the instructions for the appropriate lines on

use your complete and accurate identifying information when

Form CT-3-A, General Business Corporation Combined Franchise

completing all forms prepared for you.

Tax Return, to complete pages 1, 2, and 3 of this form. To complete

pages 4 and 5 of this form, use the instructions for the appropriate

lines on Form CT-3-A/ATT, Schedules A, B, and C – Attachment

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2