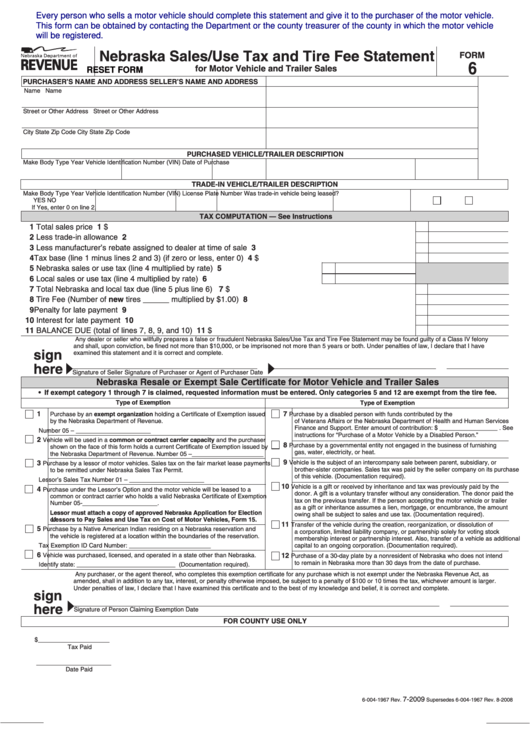

Every person who sells a motor vehicle should complete this statement and give it to the purchaser of the motor vehicle.

This form can be obtained by contacting the Department or the county treasurer of the county in which the motor vehicle

will be registered.

Nebraska Sales/Use Tax and Tire Fee Statement

FORM

6

for Motor Vehicle and Trailer Sales

RESET FORM

PURCHASER’S NAME AND ADDRESS

SELLER’S NAME AND ADDRESS

Name

Name

Street or Other Address

Street or Other Address

City

State

Zip Code

City

State

Zip Code

PURCHASED VEHICLE/TRAILER DESCRIPTION

Make

Body Type

Year

Vehicle Identification Number (VIN)

Date of Purchase

TRADE-IN VEHICLE/TRAILER DESCRIPTION

Make

Body Type

Year

Vehicle Identification Number (VIN)

License Plate Number

Was trade-in vehicle being leased?

YES

NO

If Yes, enter 0 on line 2.

TAX COMPUTATION — See Instructions

1 Total sales price ................................................................................................................................................

1 $

2 Less trade-in allowance ....................................................................................................................................

2

3 Less manufacturer’s rebate assigned to dealer at time of sale .........................................................................

3

4 Tax base (line 1 minus lines 2 and 3) (if zero or less, enter 0) ..........................................................................

4 $

5 Nebraska sales or use tax (line 4 multiplied by rate) ..............................................

5

6 Local sales or use tax (line 4 multiplied by rate) .....................................................

6

7 Total Nebraska and local tax due (line 5 plus line 6) .......................................................................................

7 $

8 Tire Fee (Number of new tires ______ multiplied by $1.00) .............................................................................

8

9 Penalty for late payment ...................................................................................................................................

9

10 Interest for late payment ...................................................................................................................................

10

11 BALANCE DUE (total of lines 7, 8, 9, and 10) ..................................................................................................

11 $

Any dealer or seller who willfully prepares a false or fraudulent Nebraska Sales/Use Tax and Tire Fee Statement may be found guilty of a Class IV felony

and shall, upon conviction, be fined not more than $10,000, or be imprisoned not more than 5 years or both. Under penalties of law, I declare that I have

sign

examined this statement and it is correct and complete.

here

Signature of Seller

Signature of Purchaser or Agent of Purchaser

Date

Nebraska Resale or Exempt Sale Certificate for Motor Vehicle and Trailer Sales

• If exempt category 1 through 7 is claimed, requested information must be entered. Only categories 5 and 12 are exempt from the tire fee.

Type of Exemption

Type of Exemption

1

7

Purchase by an exempt organization holding a Certificate of Exemption issued

Purchase by a disabled person with funds contributed by the U.S. Department

by the Nebraska Department of Revenue.

of Veterans Affairs or the Nebraska Department of Health and Human Services

Finance and Support. Enter amount of contribution: $ _________________ . See

Number 05 – ______________________

instructions for “Purchase of a Motor Vehicle by a Disabled Person.”

2

Vehicle will be used in a common or contract carrier capacity and the purchaser

8

Purchase by a governmental entity not engaged in the business of furnishing

shown on the face of this form holds a current Certificate of Exemption issued by

gas, water, electricity, or heat.

the Nebraska Department of Revenue. Number 05 –_____________________

9

3

Vehicle is the subject of an intercompany sale between parent, subsidiary, or

Purchase by a lessor of motor vehicles. Sales tax on the fair market lease payments

brother-sister companies. Sales tax was paid by the seller company on its purchase

to be remitted under Nebraska Sales Tax Permit.

of this vehicle. (Documentation required).

Lessor’s Sales Tax Number 01 – ______________________

10

Vehicle is a gift or received by inheritance and tax was previously paid by the

4

Purchase under the Lessor’s Option and the motor vehicle will be leased to a

donor. A gift is a voluntary transfer without any consideration. The donor paid the

common or contract carrier who holds a valid Nebraska Certificate of Exemption

tax on the previous transfer. If the person accepting the motor vehicle or trailer

Number 05-______________________.

as a gift or inheritance assumes a lien, mortgage, or encumbrance, the amount

Lessor must attach a copy of approved Nebraska Application for Election

owing shall be subject to sales and use tax. (Documentation required).

of Lessors to Pay Sales and Use Tax on Cost of Motor Vehicles, Form 15.

11

Transfer of the vehicle during the creation, reorganization, or dissolution of

5

Purchase by a Native American Indian residing on a Nebraska reservation and

a corporation, limited liability company, or partnership solely for voting stock

the vehicle is registered at a location within the boundaries of the reservation.

membership interest or partnership interest. Also, transfer of a vehicle as additional

Tax Exemption ID Card Number: ________________________

capital to an ongoing corporation. (Documentation required).

6

12

Vehicle was purchased, licensed, and operated in a state other than Nebraska.

Purchase of a 30-day plate by a nonresident of Nebraska who does not intend

to remain in Nebraska more than 30 days from the date of purchase.

Identify state: _____________________________ (Documentation required).

Any purchaser, or the agent thereof, who completes this exemption certificate for any purchase which is not exempt under the Nebraska Revenue Act, as

amended, shall in addition to any tax, interest, or penalty otherwise imposed, be subject to a penalty of $100 or 10 times the tax, whichever amount is larger.

Under penalties of law, I declare that I have examined this certificate and to the best of my knowledge and belief, it is correct and complete.

sign

here

Signature of Person Claiming Exemption

Date

FOR COUNTY USE ONLY

$_____________________

Tax Paid

______________________

Date Paid

7-2009

6-004-1967 Rev.

Supersedes 6-004-1967 Rev. 8-2008

1

1 2

2