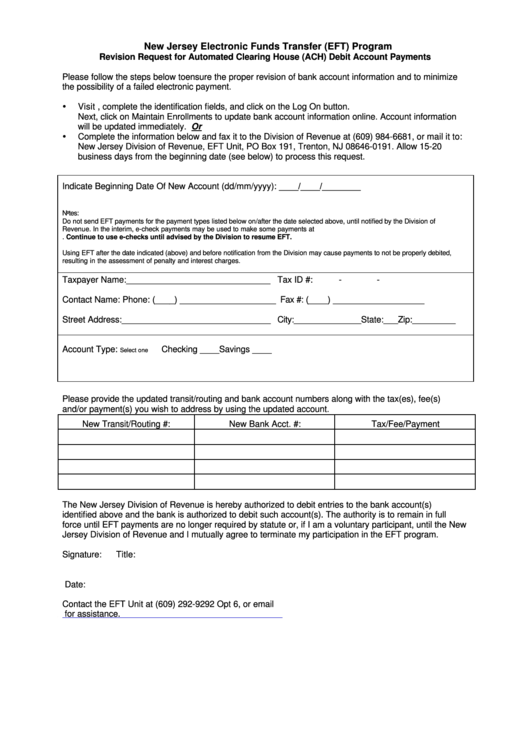

New Jersey Electronic Funds Transfer (EFT) Program

Revision Request for Automated Clearing House (ACH) Debit Account Payments

Please follow the steps below to ensure the proper revision of bank account information and to minimize

the possibility of a failed electronic payment.

Visit https:// , complete the identification fields, and click on the Log On button.

Next, click on Maintain Enrollments to update bank account information online. Account information

will be updated immediately. Or

Complete the information below and fax it to the Division of Revenue at (609) 984-6681, or mail it to:

New Jersey Division of Revenue, EFT Unit, PO Box 191, Trenton, NJ 08646-0191. Allow 15-20

business days from the beginning date (see below) to process this request.

Indicate Beginning Date Of New Account (dd/mm/yyyy): ____/____/________

Notes:

Do not send EFT payments for the payment types listed below on/after the date selected above, until notified by the Division of

Revenue. In the interim, e-check payments may be used to make some payments at

Continue to use e-checks until advised by the Division to resume EFT.

Using EFT after the date indicated (above) and before notification from the Division may cause payments to not be properly debited,

resulting in the assessment of penalty and interest charges.

Taxpayer Name: ______________________________ Tax ID #:

-

-

Contact Name: Phone: (____) ____________________ Fax #: (____) ___________________

Street Address: _______________________________ City: ______________State:___ Zip: _________

Account Type:

Checking ____

Savings ____

Select one

Please provide the updated transit/routing and bank account numbers along with the tax(es), fee(s)

and/or payment(s) you wish to address by using the updated account.

New Transit/Routing #:

New Bank Acct. #:

Tax/Fee/Payment

The New Jersey Division of Revenue is hereby authorized to debit entries to the bank account(s)

identified above and the bank is authorized to debit such account(s). The authority is to remain in full

force until EFT payments are no longer required by statute or, if I am a voluntary participant, until the New

Jersey Division of Revenue and I mutually agree to terminate my participation in the EFT program.

Signature:

Title:

Date:

Contact the EFT Unit at (609) 292-9292 Opt 6, or email

for assistance.

1

1