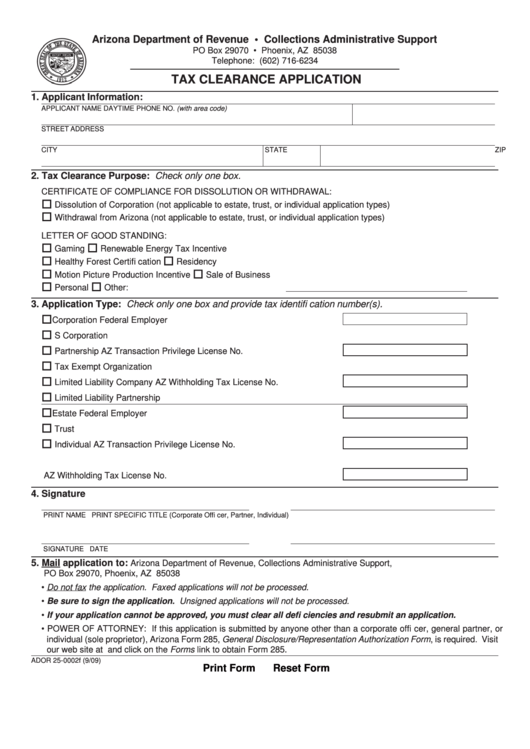

Instructions

Arizona Department of Revenue • Collections Administrative Support

PO Box 29070 • Phoenix, AZ 85038

Telephone: (602) 716-6234

TAX CLEARANCE APPLICATION

1. Applicant Information:

APPLICANT NAME

DAYTIME PHONE NO. (with area code)

STREET ADDRESS

CITY

STATE

ZIP CODE

2. Tax Clearance Purpose: Check only one box.

CERTIFICATE OF COMPLIANCE FOR DISSOLUTION OR WITHDRAWAL:

Dissolution of Corporation (not applicable to estate, trust, or individual application types)

Withdrawal from Arizona (not applicable to estate, trust, or individual application types)

LETTER OF GOOD STANDING:

Gaming

Renewable Energy Tax Incentive

Healthy Forest Certifi cation

Residency

Motion Picture Production Incentive

Sale of Business

Personal

Other:

3. Application Type: Check only one box and provide tax identifi cation number(s).

Corporation

Federal Employer I.D. No./Taxpayer I.D. No.

S Corporation

Partnership

AZ Transaction Privilege License No.

Tax Exempt Organization

Limited Liability Company

AZ Withholding Tax License No.

Limited Liability Partnership

Estate

Federal Employer I.D. No./Social Security No.

Trust

Individual

AZ Transaction Privilege License No.

AZ Withholding Tax License No.

4. Signature

PRINT NAME

PRINT SPECIFIC TITLE (Corporate Offi cer, Partner, Individual)

SIGNATURE

DATE

5. Mail application to:

Arizona Department of Revenue, Collections Administrative Support,

PO Box 29070, Phoenix, AZ 85038

• Do not fax the application. Faxed applications will not be processed.

• Be sure to sign the application. Unsigned applications will not be processed.

• If your application cannot be approved, you must clear all defi ciencies and resubmit an application.

• POWER OF ATTORNEY: If this application is submitted by anyone other than a corporate offi cer, general partner, or

individual (sole proprietor), Arizona Form 285, General Disclosure/Representation Authorization Form, is required. Visit

our web site at and click on the Forms link to obtain Form 285.

ADOR 25-0002f (9/09)

Print Form

Reset Form

1

1