Form Ftb 705 - Request For Innocent Spouse Relief Form - 2006

ADVERTISEMENT

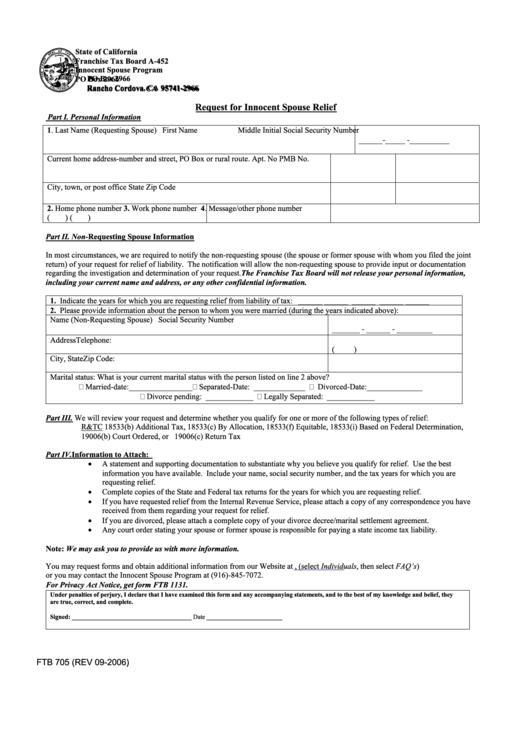

State of California

Franchise Tax Board A-452

Innocent Spouse Program

PO Box 2966

PO Box 2966

Rancho Cordova, CA 95741-2966

Rancho Cordova CA 95741-2966

Request for Innocent Spouse Relief

Part I. Personal Information

1. Last Name (Requesting Spouse)

First Name

Middle Initial

Social Security Number

______-_____ -__________

Current home address-number and street, PO Box or rural route.

Apt. No

PMB No.

City, town, or post office

State

Zip Code

2. Home phone number

3. Work phone number

4. Message/other phone number

(

)

(

)

Part II. Non-Requesting Spouse Information

In most circumstances, we are required to notify the non-requesting spouse (the spouse or former spouse with whom you filed the joint

return) of your request for relief of liability. The notification will allow the non-requesting spouse to provide input or documentation

regarding the investigation and determination of your request. The Franchise Tax Board will not release your personal information,

including your current name and address, or any other confidential information.

1. Indicate the years for which you are requesting relief from liability of tax: ______ ______ ______ ______ ______

2. Please provide information about the person to whom you were married (during the years indicated above):

Name (Non-Requesting Spouse)

Social Security Number

_______ - ______ - _________

Address

Telephone:

(

)

City, State

Zip Code:

Marital status: What is your current marital status with the person listed on line 2 above?

Married-date:________________ Separated-Date: _____________

Divorced-Date:______________

Divorce pending: ____________

Legally Separated: ____________

Part III. We will review your request and determine whether you qualify for one or more of the following types of relief:

R&TC 18533(b) Additional Tax, 18533(c) By Allocation, 18533(f) Equitable, 18533(i) Based on Federal Determination,

19006(b) Court Ordered, or 19006(c) Return Tax

Part IV. Information to Attach:

A statement and supporting documentation to substantiate why you believe you qualify for relief. Use the best

information you have available. Include your name, social security number, and the tax years for which you are

requesting relief.

Complete copies of the State and Federal tax returns for the years for which you are requesting relief.

If you have requested relief from the Internal Revenue Service, please attach a copy of any correspondence you have

received from them regarding your request for relief.

If you are divorced, please attach a complete copy of your divorce decree/marital settlement agreement.

Any court order stating your spouse or former spouse is responsible for paying a state income tax liability.

Note: We may ask you to provide us with more information.

You may request forms and obtain additional information from our Website at , (select Individuals, then select FAQ’s)

or you may contact the Innocent Spouse Program at (916)-845-7072.

For Privacy Act Notice, get form FTB 1131.

Under penalties of perjury, I declare that I have examined this form and any accompanying statements, and to the best of my knowledge and belief, they

are true, correct, and complete.

Signed: ______________________________________ Date ________________________

FTB 705 Vietnamese (REV 09-2006)

FTB 705 (REV 09-2006)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1