Form Dr-100000 - 2010 Tax Amnesty Agreement Page 3

ADVERTISEMENT

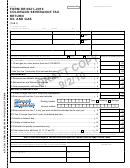

DR-100000

Get immediate confirmation

R. 06/10

of your agreement!

Apply online at

2010 Tax Amnesty Agreement

Name of entity requesting tax amnesty

Complete Physical Address of Business or Real Property

City/State/ZIP

Federal Employer Identification Number

Social Security Number * (if individual)

Business Partner Number (if registered)

Certificate Number (if registered)

Contact person

Title

Email address

Telephone No. ____ ____ ____ - ____ ____ ____ - ____ ____ ____ ____

To be eligible to participate in the amnesty program, I (the taxpayer) declare and agree that:

•

I give up my right to contest the tax and interest I report under amnesty.

•

I withdraw any pending protest or proceeding about the tax and interest I report under amnesty and understand that any protest or

proceeding cannot be refiled.

•

I have not previously entered into a settlement of liability with the Department for any state tax or local option tax that I report under

amnesty.

•

I give up my right to claim a refund of tax or interest I pay under amnesty and my right to protest the Department’s denial of any claim I

make for a refund of tax or interest I pay under amnesty.

•

Any credit or refund of tax or interest I pay under amnesty is limited to amounts paid in error, as determined by the Department.

•

I am not under criminal investigation, indictment, information, or prosecution regarding a Florida revenue law.

•

I am not under a pretrial intervention or diversion program, probation, community control, or in a work camp, jail, state prison, or

another correctional system regarding a Florida revenue law.

•

I understand that the Department may reconsider any amnesty given me if I misrepresent my eligibility to participate or I file false or

fraudulent returns and forms under amnesty.

Signature of Taxpayer ________________________________________________________________________ Date __________________________

Printed name of Taxpayer ____________________________________________________________________________________________________

Signature of Representative ** _________________________________________________________________ Date __________________________

Printed name of Representative _______________________________________________________________________________________________

*Social security numbers (SSNs) are used by the Florida Department of Revenue as unique identifiers for the administration of Florida’s taxes. SSNs obtained for tax

administration purposes are confidential under sections 213.053 and 119.071, Florida Statutes, and not subject to disclosure as public records. Collection of your SSN is

authorized under state and federal law. Visit our Internet site at and select “Privacy Notice” for more information regarding the state and federal law

governing the collection, use, or release of SSNs, including authorized exceptions.

**NOTE: A tax representative may complete a Tax Amnesty Agreement for a taxpayer only when a signed Power of Attorney (Form DR-835) is mailed with the agreement.

Mail this form to:

TAX AMNESTY PROGRAM

FLORIDA DEPARTMENT OF REVENUE

PO BOX 5138

TALLAHASSEE FL 32314-5138

Don’t delay, save today!

Take advantage of tax amnesty and save money

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3