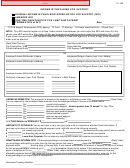

Employer’s Name: _________________________________________________ Employer FEIN: ______________________________________

Employee/Obligor’s Name: _____________________________________________________________________________________________

Remittance Identifier/Case Number: __________________________________ Cause Number: ______________________________________

Withholding limits: You may not withhold more than the lesser of: 1) the amounts allowed by the Federal Consumer Credit Protection Act

(CCPA) (15 U.S.C. 1673(b)); or 2) the amounts allowed by the State or Tribe of the employee/obligor’s principal place of employment (see

REMITTANCE INFORMATION). Disposable income is the net income left after making mandatory deduction such as: State, Federal, local taxes;

Social Security taxes; statutory pension contributions; and Medicare taxes. The Federal limit is 50% of the disposable income if the obligor is

supporting another family and 60% of the disposable income if the obligor is not supporting another family. However, those limits increase 5%

- to 55% and 65% - if the arrears are greater than 12 weeks. If permitted by the State or Tribe, you may deduct a fee for administrative costs.

The combined support amount and fee may not exceed the limit indicated in this section.

For Tribal orders, you may not withhold more than the amounts allowed under the law of the issuing Tribe. For Tribal employers/income

withholders who receive a State IWO, you may not withhold more than the lesser of the limit set by the law of the jurisdiction in which the

employer/income withholder is located or the maximum amount permitted under section 303(d) of the CCPA (15 U.S.C. 1673(b)).

Depending upon applicable State or Tribal law, you may need to also consider the amounts paid for health care premiums in determining

disposable income and applying appropriate withholding limits.

Arrears greater than 12 weeks? If the Order Information does not indicate that the arrears are greater than 12 weeks, then the Employer

should calculate the CCPA limit using the lower percentage.

Additional Information: You may retain a two dollar ($2.00) fee from the income payee’s income each time income withheld is forwarded

according to Indiana law. The sum total of the amount to be withheld plus this fee shall not exceed the maximum amount permitted under

the CCPA.

NOTIFICATION OF EMPLOYMENT TERMINATION OR INCOME STATUS: If this employee/obligor never worked for you or you are no longer

withholding income for this employee/obligor, an employer must promptly notify the CSE agency and/or sender by returning this form to

the address listed in the Contact Information below:

This person has never worked for this employer nor received periodic income.

This person no longer works for this employer nor receives periodic income.

Please provide the following information for the employee/obligor:

Termination date: _____________________________________ Last known phone number: _____________________________________

Last known address: ________________________________________________________________________________________________

_________________________________________________________________________________________________________________

Final payment date to SDU/ Tribal Payee: ___________________ Final payment amount: ________________________________________

New employer’s name: _____________________________________________________________________________________________

New employer’s address: ____________________________________________________________________________________________

_________________________________________________________________________________________________________________

CONTACT INFORMATION:

To Employer/Income Withholder: If you have any questions, contact _____________________________________________ (Issuer name)

by phone at ______________, by fax at ______________, by email or website at:______________________________________________.

Send termination/income status notice and other correspondence to: ________________________________________________________

____________________________________________________________________________________________________(Issuer address).

To Employee/Obligor: If the employee/obligor has questions, contact ____________________________________________ (Issuer name)

by phone at ______________, by fax at ______________, by email or website at:______________________________________________.

For any payment processing questions, please contact the Employer Maintenance Unit (EMU) at (317) 232-0327 or (800) 292-0403 or

EMU@dcs.in.gov.

IMPORTANT: The person completing this form is advised that the information may be shared with the employee/obligor.

1

1 2

2 3

3