For electronic payment and processing information log on to the Child Support Bureau Website at , click on

Payment Processing under Employer Services and follow the links, or call:(317) 232-0327 or (800) 292-0403.

IC 31-16-15-16 requires employers with more than 50 employees and more than one obligor/employee to process child support

payments electronically.

Include the Remittance Identifier with the payment, and if necessary this FIPS code: __________________.

Remit payment to “Indiana State Central Collection Unit” (INSCCU), at P.O. Box 6219, Indianapolis, IN 46206-6219.

If paying by check, include Remittance Identifier/Case Number, employee/obligor’s Social Security Number, and Cause Number on the

check.

The remittance form is available at .

Return to Sender [Completed by Employer/Income Withholder]. Payment must be directed to an SDU in accordance to 42 USC §

666(b)(5) and (b)(6)or Tribal Payee (see Payments to SDU below). If payment is not directed to an SDU/Tribal Payee or this IWO is not

regular on its face, you must check this box and return the IWO to the sender.

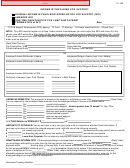

Signature of Judge/Issuing Official:

____________________________________________________________________________________

Print Name of Judge/Issuing Official:

____________________________________________________________________________________

George C. Paras

Title of Judge/Issuing Official:

____________________________________________________________________________________

Judge, Lake Circuit Court

Date of Signature:

____________________________________________________________________________________

If the employee/obligor works in a State or for a Tribe that is different from the State or Tribe that issued this order, a copy of this IWO

must be provided to the employee/obligor.

If checked, the employer/income withholder must provide a copy of this form to the employee/obligor.

ADDITIONAL INFORMATION FOR EMPLOYERS/INCOME WITHHOLDERS

State-specific contact and withholding information can be found on the Federal Employer Services website located at:

Indiana-specific information and FAQs can be found under the Employer Services section of the Child Support Bureau website at:

Priority: Withholding for support has priority over any other legal process under State law against the same income (USC 42 §666(b)(7)).

If a Federal tax levy is in effect, please notify the sender.

Combining Payments: When remitting payments to an SDU or Tribal CSE agency, you may combine withheld amounts from more than

one employee/obligor’s income in a single payment. You must, however, separately identify each employee/obligor’s portion of the

payment.

Payments to SDU: You must send child support payments payable by income withholding to the appropriate SDU or to a Tribal CSE

agency. If this IWO instructs you to send a payment to an entity other than an SDU (e.g., payable to the custodial party, court, or

attorney), you must check the box above and return this notice to the sender. Exception: If this IWO was sent by a Court, Attorney or

Private Individual/Entity and the initial order was entered before January 1, 1994 or the order was issued by a Tribal CSE agency, you

must follow the “Remit payment to” instructions on this form.

Reporting the Pay Date: You must report the pay date when sending the payment. The pay date is the date on which the amount was

withheld from the employee/obligor’s wages. You must comply with the law of the State (or Tribal law if applicable) of the

employee/obligor’s principal place of employment regarding time periods within which you must implement the withholding and forward

the support payments.

Multiple IWOs: If there is more than one IWO against this employee/obligor and you are unable to fully honor all IWOs due to federal,

State, or Tribal withholding limits, you must honor all IWOs to the greatest extent possible, giving priority to current support before

payment of any past-due support. Follow the State or Tribal law/procedure of the employee/obligor’s principal place of employment to

determine the appropriate allocation method.

Lump Sum Payments: You may be required to notify a State or Tribal CSE agency of upcoming lump sum payments to this employee/obligor

such as bonuses, commissions, or severance pay. Contact the sender to determine if you are required to report and/or withhold lump sum

payments.

Liability: If you have any doubts about the validity of this IWO, contact the sender. If you fail to withhold income from the

employee/obligor’s income as the IWO directs, you are liable for both the accumulated amount you should have withheld and penalties set

by State or Tribal law/procedure. In Indiana those penalties can be found in IC 31-16-15-23.

Anti-discrimination: You are subject to a fine determined under State or Tribal law for discharging an employee/obligor from employment,

refusing to employ, or taking disciplinary action against any employee/obligor because of this IWO. In Indiana those disciplinary actions can

be found in IC 31-16-15-25.

OMB Expiration Date – 05/31/2014. The OMB Expiration Date has no bearing on the termination date of the IWO; it identifies the version of the form currently

in use.

1

1 2

2 3

3