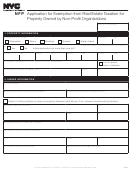

Real Estate Tax Exemption Application for Nonprofit Organizations

Page 2

S E C T I O N 2 - O R G A N I Z A T I O N P U R P O S E

1.

Check ( ) the purpose(s) of the organization from the listing below:

Bar Association

Benevolent

Bible

Cemetery

Charitable

Educational

Historical

Hospital

Infirmary

Library

Literary

Medical Society

Missionary

Parsonage or Manse

Patriotic

Public playground

Religious

Scientific

)

Supervised youth sportsmanship

Tract (religious

Enforcement of law relating to children or animals

Moral or mental improvement of men, women or children

2.

State briefly specific activities related to each purpose checked above: __________________________________________________________

__________________________________________________________________________________________________________________

__________________________________________________________________________________________________________________

S E C T I O N 3 - F E D E R A L I N C O M E T A X S T A T U S O F O R G A N I Z A T I O N

1.

Is the organization exempt from federal income tax? ..............................................................................

yes

no

IF EXEMPT, COMPLETE QUESTIONS 2, 3 AND 4 AND ATTACH A COPY OF EXEMPTION DETERMINATION OR RULING LETTER. OMIT SECTIONS 4 AND 5.

IF NOT EXEMPT, COMPLETE QUESTIONS 5 THROUGH 7 OF THIS SECTION, AND IF APPLICABLE, COMPLETE SECTIONS 4 AND 5 AND ATTACH A COPY OF

EACH RETURN FILED FOR THE ORGANIZATION FOR THE LAST FISCAL YEAR.

2.

If exempt, indicate section, subsection and paragraph of the Internal Revenue Code (IRC): ________________________________________________

3.

If exemption was recognized by an advance ruling, indicate expiration date of ruling: ______ / ______ / ______

4.

If exemption was recognized by a group exemption letter, provide name and address of organization receiving group exemption.

Organization: ______________________________________ Address: _____________________________________________________________

5.

If the organization is not currently exempt from federal income tax, has it applied for exemption? ........

yes

no

6.

If the application has been made, but not approved, indicate section, subsection and paragraph of the IRC: ___________________________________

ATTACH A COPY OF THE APPLICATION, REQUEST OR STATEMENT AND ATTACHMENTS.

7.

For the last fiscal year, did the organization file IRS Form 990-T (Exempt Organization Business Income Tax Return)? .......

yes

no

IF "YES," ATTACH COPY OF FORM 990-T.

S E C T I O N 4 - O R G A N I Z A T I O N S T A T E M E N T O F R E C E I P T S A N D E X P E N D I T U R E S

3,

1

5

"

."

C O M P L E T E O N L Y I F S E C T I O N

Q U E S T I O N S

O R

W E R E A N S W E R E D

N O

STATEMENT OF RECEIPTS AND EXPENDITURES FOR THE LAST FISCAL YEAR ENDING ______ / ______ / ______

RECEIPTS

1. Gross dues and assessments of members ...................................................................................................

1.

2. Gross contributions, gifts, etc.......................................................................................................................

2.

3. Gross amount derived from activities related to organizations exempt

purpose(s)

..................................................................................

(attach schedule)

3.

Less: Cost of sales

(attach schedule) .............................................................................

4. Gross amounts from unrelated business activities

.....................

(attach schedule)

Less: Cost of sales...............................................................................................

4.

5. Gross amount received from sales of assets, excluding inventory items

(att. sch.)

Less: Cost or other basis and sales expense of assets sold

5.

(attach schedule) ........

6. Interest, dividends, rents and royalties .........................................................................................................

6.

7. Other receipts

......................................................................................................................

(attach schedule)

7.

8. TOTAL RECEIPTS (add lines 1 through 7) ...................................................................................................

8.

continued on page 3

1

1 2

2 3

3 4

4 5

5