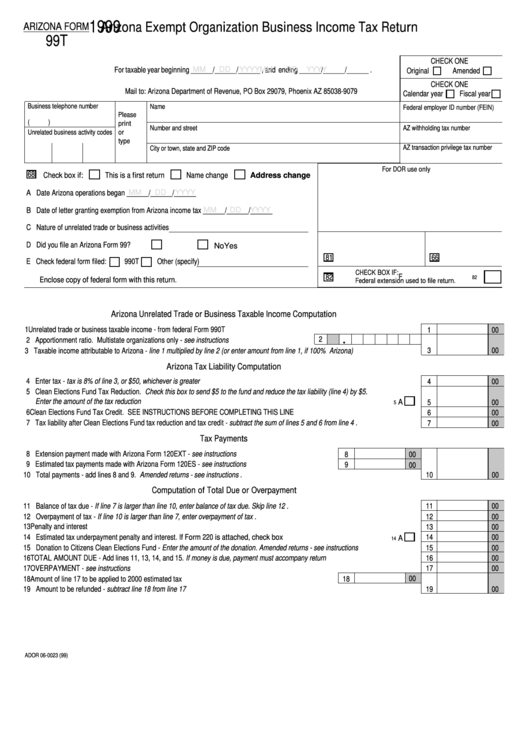

1999

Arizona Exempt Organization Business Income Tax Return

ARIZONA FORM

99T

CHECK ONE

For taxable year beginning ______/______/______ , and ending ______/______/______ .

MM

DD

YYYY

MM

DD

YYYY

Original

Amended

CHECK ONE

Mail to: Arizona Department of Revenue, PO Box 29079, Phoenix AZ 85038-9079

Calendar year

Fiscal year

Business telephone number

Name

Federal employer ID number (FEIN)

Please

(

)

print

Number and street

AZ withholding tax number

Unrelated business activity codes

or

type

AZ transaction privilege tax number

City or town, state and ZIP code

For DOR use only

68

Check box if:

This is a first return

Name change

Address change

A Date Arizona operations began ______/______/______

MM

DD

YYYY

B Date of letter granting exemption from Arizona income tax ______/______/______

MM

DD

YYYY

C Nature of unrelated trade or business activities

D Did you file an Arizona Form 99?

Yes

No

81

66

E Check federal form filed:

990T

Other (specify)

CHECK BOX IF:

82

F

82

Enclose copy of federal form with this return.

Federal extension used to file return.

Arizona Unrelated Trade or Business Taxable Income Computation

1 Unrelated trade or business taxable income - from federal Form 990T .......................................................................................................

1

00

2

2 Apportionment ratio. Multistate organizations only - see instructions .............................................

3

00

3 Taxable income attributable to Arizona - line 1 multiplied by line 2 (or enter amount from line 1, if 100% Arizona) ...................................

Arizona Tax Liability Computation

4 Enter tax - tax is 8% of line 3, or $50, whichever is greater ..........................................................................................................................

4

00

5 Clean Elections Fund Tax Reduction. Check this box to send $5 to the fund and reduce the tax liability (line 4) by $5.

Enter the amount of the tax reduction ...........................................................................................................................................

A

5

00

5

6 Clean Elections Fund Tax Credit. SEE INSTRUCTIONS BEFORE COMPLETING THIS LINE .................................................................

6

00

7 Tax liability after Clean Elections Fund tax reduction and tax credit - subtract the sum of lines 5 and 6 from line 4 ...................................

7

00

Tax Payments

8 Extension payment made with Arizona Form 120EXT - see instructions ......................................................

8

00

9 Estimated tax payments made with Arizona Form 120ES - see instructions ................................................

9

00

10 Total payments - add lines 8 and 9. Amended returns - see instructions ...................................................................................................

10

00

Computation of Total Due or Overpayment

11

11 Balance of tax due - If line 7 is larger than line 10, enter balance of tax due. Skip line 12 ..........................................................................

00

12 Overpayment of tax - If line 10 is larger than line 7, enter overpayment of tax ............................................................................................

12

00

13 Penalty and interest ......................................................................................................................................................................................

13

00

14 Estimated tax underpayment penalty and interest. If Form 220 is attached, check box ...........................................................

14

00

A

14

15 Donation to Citizens Clean Elections Fund - Enter the amount of the donation. Amended returns - see instructions ................................

15

00

16

16 TOTAL AMOUNT DUE - Add lines 11, 13, 14, and 15. If money is due, payment must accompany return ...............................................

00

17 OVERPAYMENT - see instructions ..............................................................................................................................................................

17

00

18 Amount of line 17 to be applied to 2000 estimated tax ..................................................................................

18

00

19 Amount to be refunded - subtract line 18 from line 17 .................................................................................................................................

19

00

ADOR 06-0023 (99)

1

1 2

2