Personal Income Tax Questionnaire Form

ADVERTISEMENT

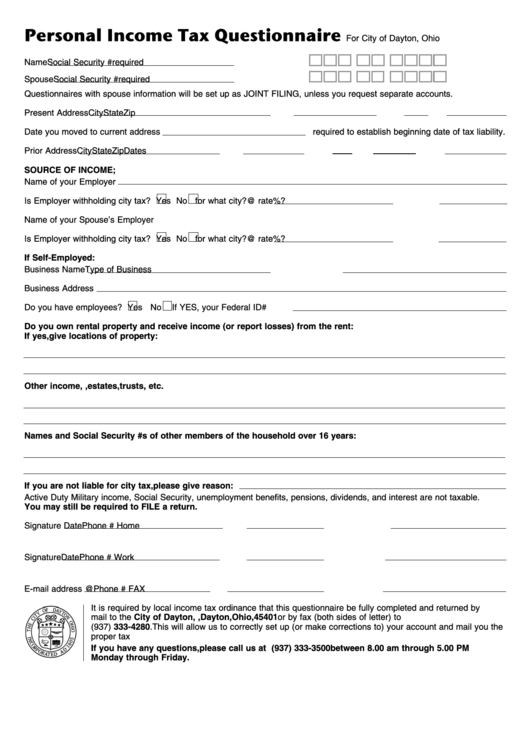

Personal Income Tax Questionnaire

For City of Dayton, Ohio

Name

Social Security #

required

Spouse

Social Security #

required

Questionnaires with spouse information will be set up as JOINT FILING, unless you request separate accounts.

Present Address

City

State

Zip

Date you moved to current address

required to establish beginning date of tax liability.

Prior Address

City

State

Zip

Dates

SOURCE OF INCOME;

Name of your Employer

Is Employer withholding city tax?

Yes

No for what city?

@ rate%?

Name of your Spouse’s Employer

Is Employer withholding city tax?

Yes

No for what city?

@ rate%?

If Self-Employed:

Business Name

Type of Business

Business Address

Do you have employees?

Yes

No

If YES, your Federal ID#

Do you own rental property and receive income (or report losses) from the rent:

If yes, give locations of property:

Other income, e.g. partnerships, estates, trusts, etc.

Names and Social Security #s of other members of the household over 16 years:

If you are not liable for city tax, please give reason:

Active Duty Military income, Social Security, unemployment benefits, pensions, dividends, and interest are not taxable.

You may still be required to FILE a return.

Signature

Date

Phone # Home

Signature

Date

Phone # Work

E-mail address

@

Phone # FAX

It is required by local income tax ordinance that this questionnaire be fully completed and returned by

mail to the City of Dayton, P. O. Box 1830, Dayton, Ohio, 45401 or by fax (both sides of letter) to

(937) 333-4280. This will allow us to correctly set up (or make corrections to) your account and mail you the

proper tax forms. Thank you for your cooperation.

If you have any questions, please call us at (937) 333-3500between 8.00 am through 5.00 PM

Monday through Friday.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1