SFN 41216 (1-2013)

Page 2 of 4

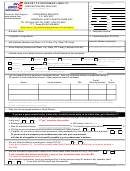

13. Are you a nonprofit organization exempt from income taxes under Section 501(c)(3), IRS Code?

Applied For - Go to #14

Yes

No - Go to #14

If yes, complete this section and submit a copy of your exemption letter from the IRS to Job Service North Dakota. You need not

complete sections 14 and 15.

As a nonprofit organization, have you employed four or more persons during 20 weeks of any calendar year in any state?

Yes

If yes, date the 20th week was first reached.

No - Go to #16

When answering Questions 14 and 15, include as employees all part-time workers and non-exempt (see Employer's Guide) corporate

officers and limited liability company managers. Do not include spouse, children under 18 who live at home, or parents of an individual owner

- this does not apply to corporations or limited liability companies. This exclusion applies to partnerships only if the worker has an exempting

relationship with each partner.

14. Enter the amount of wages you have paid in North Dakota (do not estimate or include wages earned but not paid):

Jan. 1 to March 31

April 1 to June 30

July 1 to Sept. 30

Oct. 1 to Dec. 31

Current

$

$

$

$

Year

Preceding

$

$

$

$

Year

Prior

$

$

$

$

Year

$

$

$

$

Year

15. During the 20 weeks of any calendar year, have you employed:

If yes, date the 20th week was first reached.

a.

One or more persons in general employment?

Yes

No

Yes

No

b.

Ten or more persons in agricultural employment?

16. If it is determined that you are not now liable for coverage, do you want to become covered voluntarily?

Yes

No

See NDCC 52-05-03(2) for voluntary coverage information.

Voluntary coverage is not available if you answered no to question #10

17.

Complete this section only if you are a governmental entity, Indian tribe or wholly-owned entity of an Indian tribe, or a 501(c)(3) tax

exempt organization and answered yes to either Question 13 or 16.

Select one of the following benefit financing options: (see NDCC 52-04-18 for benefit financing methods)

Reimbursement of benefit payments attributable to employment with your organization.

Payment of taxes on your quarterly taxable payroll at the rate applicable for new employers.

Advanced reimbursements at a percent of your quarterly total payroll to be redetermined annually.

Will default to Payment of Taxes: 1) if not completed and/or 2) if you have not provided an IRS exemption letter.

18. Have any individuals you do not consider employees performed services for you in North Dakota?

Yes

No

If yes, give reasons for excluding them and indicate number of persons involved.

Yes

No

19. Does any part of your business activity include the provision of "temporary" or "leased" workers to a client company?

20. Give a specific description of your business activity in North Dakota.

Enter on separate lines the principal product or activities of your firm. Following each item, list the percentage of sales value or receipts

received from the product or activity; i.e., retail men's clothing, electrical construction-residential, or long haul trucking-refrigerated van.

%

%

%

%

1

1 2

2 3

3 4

4