Franchise And Excise Tax - Family-Owned Noncorporate Entity - Disclosure Of Activity - Tennessee Department Of Revenue Form

ADVERTISEMENT

Instructions

Print

Reset

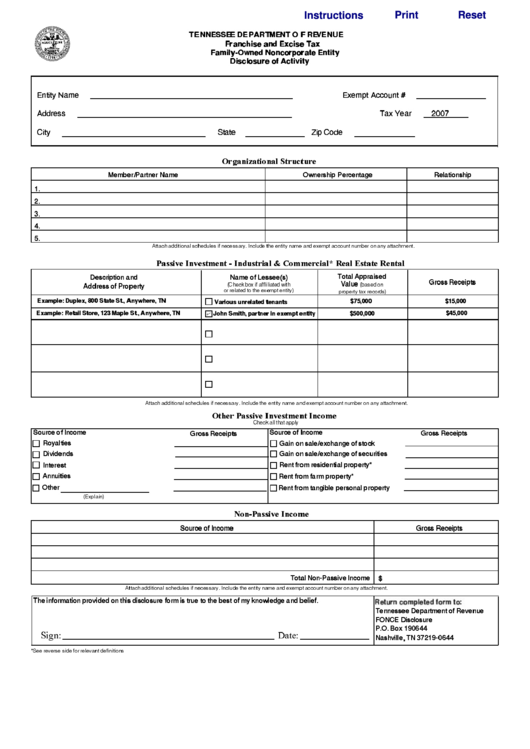

TENNESSEE DEPARTMENT O F REVENUE

Franchise and Excise Tax

Family-Owned Noncorporate Entity

Disclosure of Activity

Entity Name

Exempt Account #

Address

Tax Year

2007

City

State

Zip Code

Organizational Structure

Member/Partner Name

Ownership Percentage

Relationship

1.

2.

3.

4.

5.

Attach additional schedules if necessary. Include the entity name and exempt account number on any attachment.

Passive Investment - Industrial & Commercial* Real Estate Rental

Total Appraised

Description and

Name of Lessee(s)

Gross Receipts

Value

(based on

Address of Property

(Check box if affliliated with

or related to the exempt entity)

property tax records)

Example: Duplex, 800 State St., Anywhere, TN

$75,000

$15,000

Various unrelated tenants

Example: Retail Store, 123 Maple St., Anywhere, TN

$45,000

John Smith, partner in exempt entity

$500,000

Attach additional schedules if necessary. Include the entity name and exempt account number on any attachment.

Other Passive Investment Income

Check all that apply

Source of Income

Source of Income

Gross Receipts

Gross Receipts

Royalties

Gain on sale/exchange of stock

Dividends

Gain on sale/exchange of securities

Rent from residential property*

Interest

Annuities

Rent from farm property*

Other

Rent from tangible personal property

(Explain)

Non-Passive Income

Source of Income

Gross Receipts

Total Non-Passive Income

$

Attach additional schedules if necessary. Include the entity name and exempt account number on any attachment.

Return complete form to:

The information provided on this disclosure form is true to the best of my knowledge and belief.

Tennessee Department of Revenue

FONCE Disclosure

P.O. Box 190644

Nashville, TN 37219-0644

Sign:

Date:

*See reverse side for relevant definitions

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2