Form 1118 - Instructions For Schedule J Sheet

ADVERTISEMENT

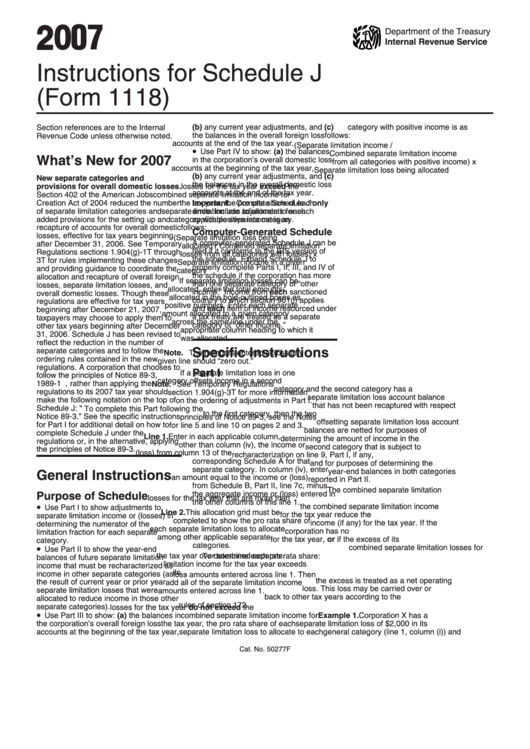

2 0 07

Department of the Treasury

Internal Revenue Service

Instructions for Schedule J

(Form 1118)

(b) any current year adjustments, and (c)

category with positive income is as

Section references are to the Internal

the balances in the overall foreign loss

follows:

Revenue Code unless otherwise noted.

accounts at the end of the tax year.

(Separate limitation income /

•

Use Part IV to show: (a) the balances

Combined separate limitation income

What’s New for 2007

in the corporation’s overall domestic loss

from all categories with positive income) x

accounts at the beginning of the tax year,

Separate limitation loss being allocated

(b) any current year adjustments, and (c)

New separate categories and

3. If the combined separate limitation

the balances in the overall domestic loss

provisions for overall domestic losses.

losses for the tax year exceed the

accounts at the end of the tax year.

Section 402 of the American Jobs

combined separate limitation income for

Creation Act of 2004 reduced the number

Important. Complete Schedule J only

the tax year, the pro rata share of each

of separate limitation categories and

once. Include adjustments for each

separate limitation loss to allocate to each

added provisions for the setting up and

applicable separate category.

category with positive income is as

recapture of accounts for overall domestic

follows:

Computer-Generated Schedule

losses, effective for tax years beginning

(Separate limitation loss being

A computer-generated Schedule J can be

after December 31, 2006. See Temporary

allocated / Combined separate limitation

filed if it conforms to the IRS version of

Regulations sections 1.904(g)-1T through

losses from all categories with losses) x

the schedule. Expand Schedule J to

3T for rules implementing these changes

Separate limitation income in a given

properly complete Parts I, II, III, and IV of

and providing guidance to coordinate the

category

the schedule if the corporation has more

allocation and recapture of overall foreign

If separate limitation losses can be

than one separate category of “other

losses, separate limitation losses, and

allocated, enter the total amounts

income.” Income from each sanctioned

overall domestic losses. Though these

allocated in the bold-outlined boxes as

country to which section 901(j) applies

regulations are effective for tax years

positive numbers. Enter each separate

and each item of income resourced under

beginning after December 21, 2007,

amount allocated to a given category

a tax treaty are treated as a separate

taxpayers may choose to apply them to

across the same line under the

category of “other income.”

other tax years beginning after December

appropriate column heading to which it

31, 2006. Schedule J has been revised to

was allocated.

reflect the reduction in the number of

separate categories and to follow the

Specific Instructions

Note. The numbers entered across any

ordering rules contained in the new

given line should “zero out.”

regulations. A corporation that chooses to

Part I

If a separate limitation loss in one

follow the principles of Notice 89-3,

category offsets income in a second

1989-1 C.B. 623, rather than applying the

Note. See Temporary Regulations

category and the second category has a

regulations to its 2007 tax year should

section 1.904(g)-3T for more information

separate limitation loss account balance

make the following notation on the top of

on the ordering of adjustments in Part I.

that has not been recaptured with respect

Schedule J: “U.S. Loss Allocation Under

To complete this Part following the

to the first category, then the two

Notice 89-3.” See the specific instructions

principles of Notice 89-3, see the Notes

offsetting separate limitation loss account

for Part I for additional detail on how to

for line 5 and line 10 on pages 2 and 3.

balances are netted for purposes of

complete Schedule J under the

Line 1. Enter in each applicable column,

determining the amount of income in the

regulations or, in the alternative, applying

other than column (iv), the income or

second category that is subject to

the principles of Notice 89-3.

(loss) from column 13 of the

recharacterization on line 9, Part I, if any,

corresponding Schedule A for that

and for purposes of determining the

separate category. In column (iv), enter

year-end balances in both categories

General Instructions

an amount equal to the income or (loss)

reported in Part II.

from Schedule B, Part II, line 7c, minus

The combined separate limitation

the aggregate income or (loss) entered in

Purpose of Schedule

losses for the tax year that are more than

the other columns of this line 1.

•

the combined separate limitation income

Use Part I to show adjustments to

Line 2. This allocation grid must be

for the tax year reduce the U.S. source

separate limitation income or (losses) in

completed to show the pro rata share of

income (if any) for the tax year. If the

determining the numerator of the

each separate limitation loss to allocate

corporation has no U.S. source income

limitation fraction for each separate

among other applicable separate

for the tax year, or if the excess of its

category.

categories.

•

combined separate limitation losses for

Use Part II to show the year-end

To determine each pro rata share:

the tax year over combined separate

balances of future separate limitation

limitation income for the tax year exceeds

income that must be recharacterized as

1. Add all of the separate limitation

its U.S. source income for the tax year,

income in other separate categories (as

loss amounts entered across line 1. Then

the excess is treated as a net operating

the result of current year or prior year

add all of the separate limitation income

loss. This loss may be carried over or

separate limitation losses that were

amounts entered across line 1.

back to other tax years according to the

allocated to reduce income in those other

2. If the combined separate limitation

rules of section 172.

separate categories).

losses for the tax year do not exceed the

•

Use Part III to show: (a) the balances in

combined separate limitation income for

Example 1. Corporation X has a

the corporation’s overall foreign loss

the tax year, the pro rata share of each

separate limitation loss of $2,000 in its

accounts at the beginning of the tax year,

separate limitation loss to allocate to each

general category (line 1, column (i)) and

Cat. No. 50277F

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4