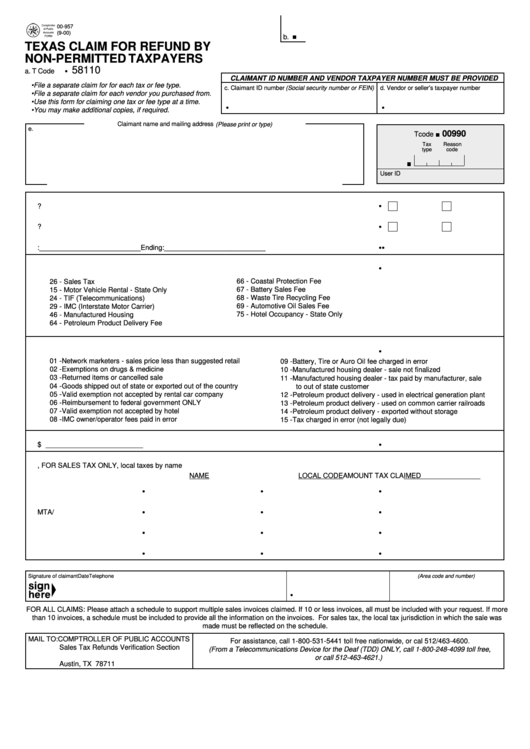

00-957

(9-00)

b.

TEXAS CLAIM FOR REFUND BY

NON-PERMITTED TAXPAYERS

58110

•

a. T Code

CLAIMANT ID NUMBER AND VENDOR TAXPAYER NUMBER MUST BE PROVIDED

• File a separate claim for for each tax or fee type.

c. Claimant ID number (Social security number or FEIN)

d. Vendor or seller’s taxpayer number

• File a separate claim for each vendor you purchased from.

• Use this form for claiming one tax or fee type at a time.

•

•

• You may make additional copies, if required.

Claimant name and mailing address (Please print or type)

e.

00990

Tcode

Tax

Reason

type

code

User ID

•

1. Is this your first claim? ..................................................................................................................................

YES

NO

•

2. Is this a different address? ...........................................................................................................................

YES

NO

•

•

3. Period of claim .................................................. Beginning:

__________________________ Ending:

__________________________

•

4. Please indicate tax type or fee which refund request is based upon ...........................................................

__________________________

66 - Coastal Protection Fee

26 - Sales Tax

67 - Battery Sales Fee

15 - Motor Vehicle Rental - State Only

68 - Waste Tire Recycling Fee

24 - TIF (Telecommunications)

69 - Automotive Oil Sales Fee

29 - IMC (Interstate Motor Carrier)

75 - Hotel Occupancy - State Only

46 - Manufactured Housing

64 - Petroleum Product Delivery Fee

•

5. Please indicate reason refund is being equested or tax was paid in error ...................................................

__________________________

01 - Network marketers - sales price less than suggested retail

09 - Battery, Tire or Auro Oil fee charged in error

02 - Exemptions on drugs & medicine

10 - Manufactured housing dealer - sale not finalized

03 - Returned items or cancelled sale

11 - Manufactured housing dealer - tax paid by manufacturer, sale

04 - Goods shipped out of state or exported out of the country

to out of state customer

05 - Valid exemption not accepted by rental car company

12 - Petroleum product delivery - used in electrical generation plant

06 - Reimbursement to federal government ONLY

13 - Petroleum product delivery - used on common carrier railroads

07 - Valid exemption not accepted by hotel

14 - Petroleum product delivery - exported without storage

08 - IMC owner/operator fees paid in error

15 - Tax charged in error (not legally due)

•

6. Total amount of refund claimed ....................................................................................................................

$ _________________________

7. Please indicate, FOR SALES TAX ONLY, local taxes by name

NAME

LOCAL CODE

AMOUNT TAX CLAIMED

•

•

•

City ...........................................

__________________________

__________________________

__________________________

•

•

•

MTA/CTD ..................................

__________________________

__________________________

__________________________

•

•

•

County ......................................

__________________________

__________________________

__________________________

•

•

•

SPD ..........................................

__________________________

__________________________

__________________________

Signature of claimant

Date

Telephone (Area code and number)

•

FOR ALL CLAIMS: Please attach a schedule to support multiple sales invoices claimed. If 10 or less invoices, all must be included with your request. If more

than 10 invoices, a schedule must be included to provide all the information on the invoices. For sales tax, the local tax jurisdiction in which the sale was

made must be reflected on the schedule.

MAIL TO: COMPTROLLER OF PUBLIC ACCOUNTS

For assistance, call 1-800-531-5441 toll free nationwide, or cal 512/463-4600.

Sales Tax Refunds Verification Section

(From a Telecommunications Device for the Deaf (TDD) ONLY, call 1-800-248-4099 toll free,

P.O. Box 13528

or call 512-463-4621.)

Austin, TX 78711

1

1