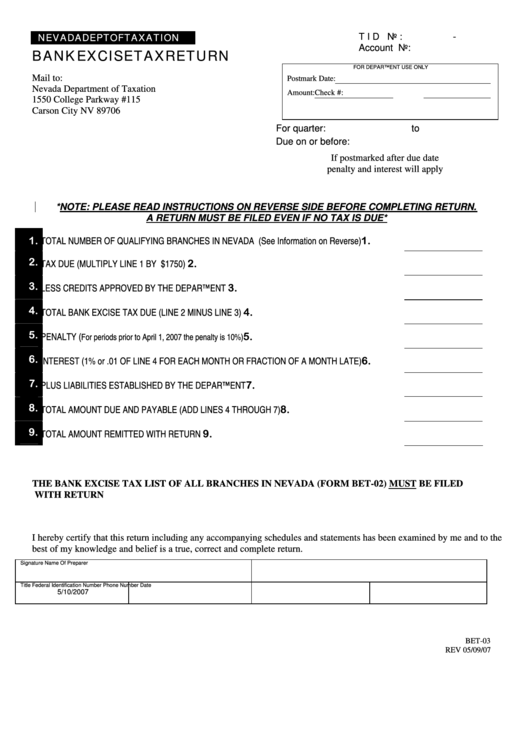

Form Bet-02/3 - Bank Excise Tax Return May 2007

ADVERTISEMENT

NEVADA DEPT OF TAXATION

TID No:

-

Account No:

BANK EXCISE TAX RETURN

FOR DEPARTMENT USE ONLY

Mail to:

Postmark Date:

Nevada Department of Taxation

Amount:

Check #:

1550 College Parkway #115

Carson City NV 89706

For quarter:

to

Due on or before:

If postmarked after due date

penalty and interest will apply

*NOTE: PLEASE READ INSTRUCTIONS ON REVERSE SIDE BEFORE COMPLETING RETURN.

A RETURN MUST BE FILED EVEN IF NO TAX IS DUE*

1.

1.

TOTAL NUMBER OF QUALIFYING BRANCHES IN NEVADA (See Information on Reverse)

2.

2.

TAX DUE (MULTIPLY LINE 1 BY $1750)

3.

3.

LESS CREDITS APPROVED BY THE DEPARTMENT

4.

4.

TOTAL BANK EXCISE TAX DUE (LINE 2 MINUS LINE 3)

5.

5.

PENALTY (

For periods prior to April 1, 2007 the penalty is 10%)

6.

6.

INTEREST (1% or .01 OF LINE 4 FOR EACH MONTH OR FRACTION OF A MONTH LATE)

7.

7.

PLUS LIABILITIES ESTABLISHED BY THE DEPARTMENT

8.

8.

TOTAL AMOUNT DUE AND PAYABLE (ADD LINES 4 THROUGH 7)

9.

9.

TOTAL AMOUNT REMITTED WITH RETURN

THE BANK EXCISE TAX LIST OF ALL BRANCHES IN NEVADA (FORM BET-02) MUST BE FILED

WITH RETURN

I hereby certify that this return including any accompanying schedules and statements has been examined by me and to the

best of my knowledge and belief is a true, correct and complete return.

Signature

Name Of Preparer

Title

Federal Identification Number

Phone Number

Date

5/10/2007

BET-03

REV 05/09/07

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3